SubDRSive 4 weeks ago • 100%

I'm out of the loop on these drawings...are they a take on game maps or floor plans?

SubDRSive 2 months ago • 100%

I think they should impound that unfinished Chinese tower with the graffiti and hire homeless people to make it into homeless housing.

www.latimes.com

www.latimes.com

The county of Los Angeles has tentatively agreed to buy the Gas Company Tower, a prominent office skyscraper in downtown Los Angeles, for $215 million in a foreclosure sale. The price is a deep discount from its appraised value of $632 million in 2020, underscoring how much downtown office values have fallen in recent years.

SubDRSive 2 months ago • 100%

LONDON (AP) — The Bank of England has cut interest rates for the first time since the onset of the COVID-19 pandemic in early 2020 as inflationary pressures in the economy have eased. In a statement Thursday, the bank said that by a 5-4 margin, its policymaking panel backed a quarter-point reduction in its main interest rate to 5%, from the 16-year high of 5.25%. It's the latest central bank to cut interest rates following a long stretch of increases. The U.S. Federal Reserve has yet to take the step but many think it will be ready to next month. Many economists thought that the Bank of England, which is independent of government, would join the Fed in keeping rates on hold once again given persistent price pressures in the services sector, which accounts for around 80% of the British economy. ... Though those concerns remain, certainly among the four opting to keep borrowing rates on hold, the majority on the panel think the hard medicine of higher borrowing costs has worked, with inflation in the U.K overall down at the bank’s target of 2%. “Inflationary pressures have eased enough that we’ve been able to cut interest rates today,” said Bank Gov. Andrew Bailey, who voted for a cut. “But we need to make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much. Ensuring low and stable inflation is the best thing we can do to support economic growth and the prosperity of the country.” Bailey’s comment suggests that interest rates will not be falling dramatically over coming months, certainly nowhere near the pace that the bank had hiked them in recent years. Central banks around the world dramatically increased borrowing costs from near zero during the coronavirus pandemic when prices started to shoot up, first as a result of supply chain issues built up during the pandemic and then because of Russia’s full-scale invasion of Ukraine which pushed up energy costs. Though no one is anticipating rates to fall to those previous lows, there are widespread expectations that the bank will cut again in coming months, especially as its forecasts suggest inflation will be below target in the next couple of years, despite a modest increase in the second half of the year. “But ultimately it is the data that will determine how interest rates evolve from here, with the bank hoping its conviction that underlying inflation pressures are fading will be vindicated,” said Luke Bartholomew, deputy chief economist at abrdn, formerly known as Aberdeen Asset Management. The cut — and the potential of future cuts — are welcome news to millions of mortgage holders, certainly those whose borrowing costs track the bank’s headline rate, though it will likely mean that the savings rates offered by banks will be reduced. David Hollingworth, associate director at L&C Mortgages, said the prospect of further rate cuts will help boost consumer confidence and that could help the housing market. “That will be important reassurance to many that have been scarred by the turbulent and volatile periods in the mortgage market over the last couple of years," he said. Higher interest rates — which cool the economy by making it more expensive to borrow — have helped ease inflation, but they’ve weighed on the British economy, which has barely grown since the pandemic rebound. Critics of the Bank of England say it has being overly cautious about inflation in recent months and that it had maintained high interest rates for too long, unnecessarily harming the economy. Borrowing costs had been held at 5.25% since August last year, even though inflation was clearly on a downtrend while the economy stagnated. It is a charge that’s also been leveled against the U.S. Federal Reserve, which kept rates unchanged on Wednesday. It is widely anticipated that the Fed will Other central banks, including the European Central Bank, have opted to cut rates but are doing so cautiously. July 31, 2024|Updated August 1, 2024 8:00 a.m. PAN PYLAS

dailyhodl.com

dailyhodl.com

Two of the largest banks in the US are declaring a loss on a whopping $3.5 billion in debts that customers can’t pay back. JPMorgan Chase says its net charge-offs, which are delinquent debts that banks do not expect to receive, hit $2.2 billion in the second quarter of the year. That’s a $200 million increase from the previous quarter and an $800 million increase from Q2 of 2023. Meanwhile, Wells Fargo says its net charge-offs surged from $764 million in Q2 of 2023 to $1.3 billion last quarter – a 70% increase. Although the pace of inflation has reduced, Wells Fargo’s chief financial officer Michael Santomassimo says many customers are clearly struggling as their credit card balances rise and savings dwindle, reports the New York Times. “[Inflation is] still cumulatively having a bit impact. The folks on the lower end of the wealth or income spectrum are struggling more than folks that are on the higher end.” In addition to its charge-offs, JPMorgan declared an additional $500 million in losses from failing mortgage investments. US banks have been sounding the alarm on their customers’ growing credit card balances and issues in the commercial real estate industry since last year. In its new report, Wells Fargo says it earned a Q2 profit of $4.9 billion, although the bank’s shares tumbled 6% on Friday after net interest income fell short of estimates. JPMorgan Chase reported a quarterly profit of $13.1 billion as its stock hovers near its all-time high.

SubDRSive 3 months ago • 100%

And sticky...

SubDRSive 3 months ago • 100%

Citadel CEO Kenneth Griffin in recent photo wearing a generic fast food worker uniform standing at order counter of fast food restaurant...

Citadel CEO Kenneth Griffin at current age wearing a generic fast food worker uniform standing at order counter of fast food restaurant...

SubDRSive 3 months ago • 100%

Might help... https://youtu.be/qm3lrHqscik

SubDRSive 4 months ago • 100%

Marge called someone this morning. And their story wasn't convincing this time.

So a sub-penny stock in a dead company suddenly changes registrars. And none of the search engines I use seem to work this morning. The revolution will not be searchable. EDIT; turns out it's just Bing and Copilot failing... https://www.theregister.com/2024/05/23/bing_and_copilot_fall_from/

www.theregister.com

www.theregister.com

Nice to know they're on top of their tech when my DRS depends on it... "And Computershare is big: the Australian company had revenue of $3.3 billion last year, its 14,000-plus staff work across more than 20 countries, serving 40,000 clients and 75 million end-customers. All of which requires 24,000 VMs – a fleet few orgs will match."

https://www.reddit.com/r/Superstonk/s/9Mrw1OnwkS https://www.reddit.com/r/Superstonk/s/6UCtww93UB https://www.reddit.com/r/Superstonk/s/0riinDTG2l https://www.reddit.com/r/Superstonk/s/UAtkfWwG1d https://www.reddit.com/r/Superstonk/s/ZwBH9KL425 https://www.reddit.com/r/Superstonk/s/BizpwMAzvb https://www.reddit.com/r/Superstonk/s/cgg6iKqXsi https://www.reddit.com/r/Superstonk/s/ueWSGIFTdm https://www.reddit.com/r/Superstonk/s/7E17M2dfPY https://www.reddit.com/r/Superstonk/s/1MRCid7h7v https://www.reddit.com/r/Superstonk/s/qRaAcvbGN8 https://www.reddit.com/r/Superstonk/s/mDwUgyTwwj https://www.reddit.com/r/Superstonk/s/MomNsGbfsC =========== End of Message Now, this is something I personally want to add: this what happened to him it's the last of many shitty things that happened during this saga. When the time comes, remember all these events, how people got abused and harrassed - and make them pay the RIGHT price (which is a cell and all they own and more). Because I will. Oh, if I will... 💎🤲🏻

SubDRSive 4 months ago • 100%

In my view they've changed the presentation of Plan a few times.

They had Maginot Lines, first just buy from Robinhood, then a "real" broker, then DRS (huge battle) , the Plan is great because better, than broker, then Book only...reddit mods who participated in any of that were complicit. If they didn't get paid for that self-compromise they're morons.

Sparkles might be both.

I still think Plan is better than broker, registered to holder and voting. But door is ajar and unlocked.

They fought every step: In a way that was a kind of a diagram by itself.

This one's been around in other media, tallest building in Ft Worth just sold for 10% at a foreclosure auction. This on top of the pressure from work from home and GME investors not budging.

Looks like an interesting day ahead. I'm drinking lots of water. Edit: I ffnd myself in agreement with speculation that this might be a dangerous and expensive (desperate?) rug pull to buck more investors off their back. Likely will just demonstrate how disconnected they are and might run away from them.

I get an error and need to reload nearly every time. https://sitereport.netcraft.com/?url=http://lemmy.whynotdrs.org I wonder if cloudflare has any connections with shf's.

SubDRSive 5 months ago • 100%

Fractional shares were one thing that convinced me to book.

SubDRSive 5 months ago • 100%

Second time around, they're hoping we'll miss this one. Link...https://old.reddit.com/r/Superstonk/comments/1ciqum4/simians_smash_sec_rule_proposal_to_reduce_margin/ From post, full post has long template... "Well done fellow Simians! 👏 Thanks to OVER 2500+ of you beautiful apes, the SEC has decided the OCC Proposal to Reduce Margin Requirements To Prevent A Cascade of Clearing Member Failures is dog shit wrapped in cat shit. We need to kick this while it's down so it's out of the game. ... the Commission is providing notice of the grounds for disapproval under consideration. [SR-OCC-2024-001 34-100009 (pg 4); Federal Register] Notice of the grounds for DISAPPROVAL The phrase "notice of the grounds for DISAPPROVAL" is formal speak for "here are the reasons why this is bullshit". HOWEVER, the rule proposal isn't dead yet. Part of the bureaucratic process is this notification of why it should be disapproved followed by a comment period where the rule proposer and supporters (e.g., OCC, Wall St, and Kenny's friends) can comment and try to push this through by convincing the SEC otherwise. Apes can also comment on the rule proposal IN SUPPORT OF THE SEC and the grounds for disapproval. It's time to kick this to the curb. SEC's Reasons This Proposal Is BS..."

www.bbc.com

www.bbc.com

So far today the CEO of HSBC has suddenly resigned… https://archive.ph/SgxD2 archive.today webpage capture Saved from https://www.bbc.com/news/articles/czkvnd4g44ro no other snapshots from this url 30 Apr 2024 13:31:34 UTC HSBC chief executive unexpectedly steps down 7 hours ago João da Silva, Business reporter Noel Quinn has led the banking giant for nearly five years. HSBC’s group chief executive Noel Quinn is unexpectedly retiring after nearly five years in the role. Europe’s largest bank says it is in the process of finding a successor for 62-year-old Mr Quinn, who will stay in the role until a new chief executive is named. HSBC is considering candidates from both inside and outside the firm. It comes as the UK-based lender reported a 1.8% drop in profit for the first three months of 2024, compared to the same time last year. The company said that its pre-tax profit for the period came in at $12.7bn (£10bn), which was a little better than expected by market analysts. "After an intense five years, it is now the right time for me to get a better balance between my personal and business life,” Mr Quinn said. Mr Quinn, who has worked at HSBC for 37 years, was first appointed as its chief executive on an interim basis in 2019, after his predecessor John Flint was ousted from the role. In March 2020, he took the reins of HSBC on a permanent basis. “[Mr Quinn] has driven both our transformation strategy and created a simpler, more focused business that delivers higher returns,” HSBC’s chairman Mark Tucker said. Along with its quarterly results, the bank announced an interim payout to investors of $0.10 per share and said it would buy back up to $3bn of its shares. HSBC recently completed the sale of its operations in Canada and announced plans to do the same with its business in Argentina. The sales are part of efforts by the London-based bank to focus more on faster-growing markets in Asia. Shanti Kelemen, chief investment office at M&G Wealth, told the BBC’s Today programme that it “has probably been a very intense five years” and that Mr Quinn “has had a very long career”. She said that Mr Quinn had changed the shape of the bank during his time at the top, by such actions as selling HSBC’s Argentina business, leaving Canada, and stepping up Asia operations. “What he’s done will probably reverberate and determine the path of their success for certainly several years to come,” she added. UK banking International Business HSBC

SubDRSive 5 months ago • 100%

So far today the CEO of HSBC has suddenly resigned... https://archive.ph/SgxD2

archive.today webpage capture Saved from https://www.bbc.com/news/articles/czkvnd4g44ro no other snapshots from this url 30 Apr 2024 13:31:34 UTC

HSBC chief executive unexpectedly steps down 7 hours ago João da Silva, Business reporter

Noel Quinn has led the banking giant for nearly five years HSBC's group chief executive Noel Quinn is unexpectedly retiring after nearly five years in the role. Europe's largest bank says it is in the process of finding a successor for 62-year-old Mr Quinn, who will stay in the role until a new chief executive is named. HSBC is considering candidates from both inside and outside the firm. It comes as the UK-based lender reported a 1.8% drop in profit for the first three months of 2024, compared to the same time last year. The company said that its pre-tax profit for the period came in at $12.7bn (£10bn), which was a little better than expected by market analysts. "After an intense five years, it is now the right time for me to get a better balance between my personal and business life,” Mr Quinn said. Mr Quinn, who has worked at HSBC for 37 years, was first appointed as its chief executive on an interim basis in 2019, after his predecessor John Flint was ousted from the role. In March 2020, he took the reins of HSBC on a permanent basis. "[Mr Quinn] has driven both our transformation strategy and created a simpler, more focused business that delivers higher returns," HSBC's chairman Mark Tucker said. Along with its quarterly results, the bank announced an interim payout to investors of $0.10 per share and said it would buy back up to $3bn of its shares. HSBC recently completed the sale of its operations in Canada and announced plans to do the same with its business in Argentina. The sales are part of efforts by the London-based bank to focus more on faster-growing markets in Asia. Shanti Kelemen, chief investment office at M&G Wealth, told the BBC's Today programme that it "has probably been a very intense five years" and that Mr Quinn "has had a very long career". She said that Mr Quinn had changed the shape of the bank during his time at the top, by such actions as selling HSBC's Argentina business, leaving Canada, and stepping up Asia operations. "What he's done will probably reverberate and determine the path of their success for certainly several years to come," she added. UK banking International Business HSBC

SubDRSive 5 months ago • 100%

It made the NY Post, but that rag needs me to turn off adblockers and send a nude photo to be able to read the article.

"The Pennsylvania Department of Banking and Securities closed Republic First Bank (operating as Republic Bank), with the FDIC appointed as receiver. Fulton Bank has agreed to assume nearly all deposits and purchase almost all assets of Republic Bank. Republic Bank's 32 branches across New Jersey, Pennsylvania, and New York will reopen as Fulton Bank branches, and customers can access their funds through checks, ATMs, or debit cards. Existing checks and loan payments will continue to be processed as usual. Depositors of Republic Bank will automatically become depositors of Fulton Bank, maintaining their existing deposit insurance coverage without needing to change their banking relationships. As of January 31, 2024, Republic Bank had about $6 billion in assets and $4 billion in deposits. The estimated cost of this bank failure to the FDIC’s Deposit Insurance Fund is $667 million, with the acquisition by Fulton Bank being the least costly resolution compared to other options.

Posted on Supa... TLDRS "The Pennsylvania Department of Banking and Securities closed Republic First Bank (operating as Republic Bank), with the FDIC appointed as receiver. Fulton Bank has agreed to assume nearly all deposits and purchase almost all assets of Republic Bank. Republic Bank's 32 branches across New Jersey, Pennsylvania, and New York will reopen as Fulton Bank branches, and customers can access their funds through checks, ATMs, or debit cards. Existing checks and loan payments will continue to be processed as usual. Depositors of Republic Bank will automatically become depositors of Fulton Bank, maintaining their existing deposit insurance coverage without needing to change their banking relationships. As of January 31, 2024, Republic Bank had about $6 billion in assets and $4 billion in deposits. The estimated cost of this bank failure to the FDIC’s Deposit Insurance Fund is $667 million, with the acquisition by Fulton Bank being the least costly resolution compared to other options."

" A steep price cut on a San Francisco building marks one of the starkest recent indicators of the city’s struggling office market. An empty 16-story building at 995 Market St. just sold for $6.5 million, a nearly 90% plunge from its 2016 price of $62 million. The mid-Market tower at the corner of Sixth Street once housed Burning Man’s headquarters, as well as a large WeWork space. But once the co-working firm departed, the building failed to fill the gap and hasn’t been generating revenue for some time. The site’s previous owner, Bridgeton, stopped making monthly payments on the tower last year and defaulted on its loan in December. The public auction sale, which the San Francisco Business Times first reported on, marks a stunning discount for the buyer, LNR Partners, an affiliate of Florida-based investor Starwood Property Trust. LNR had also been appointed to oversee the distressed loan. The price drop reflects the site’s transition from a leased-out hub during during a boom-time for tech, to a space that’s sat empty while remote work has ravaged San Francisco offices overall. “Office markets are going through what some are calling ‘The Great Reset,’” Derek Daniels, regional director of research at Colliers, told SFGATE. The market of today isn’t the market of 2016, and sales like this reflect a necessary adjustment. Buildings changing hands and resetting their values will also affect rents and lease rates across the market, he said. “Any transactions happening right now, particularly in the mid-Market area, are a generally positive sign for San Francisco offices,” he added"

Dismal just posted this on Super stonk... "On April 30, 2024 DTC will implement changes to modify collateral value for certain securities, which may affect the value of positions applied to the Collateral Monitor. The increase in the haircut for corporate bonds rated B1 to B3 from 50% to 70% significantly decreases the value of these bonds as collateral. The assignment of a 100% haircut to ETFs and investment vehicles that include cryptocurrencies as an underlying asset renders these investments valueless for collateral purposes. This reduction may lead to margin calls for participants using these instruments to secure short positions against GameStop." OG file... https://www.dtcc.com/-/media/Files/pdf/2024/4/26/B20002-24.pdf Dismal's writeup with charts... https://dismal-jellyfish.com/significant-changes-to-dtc-collateral-values-announced/

www.theregister.com

www.theregister.com

No reason to go to the link unless you're in IT in some way, but someone mentioned in that convo that AI companies are floating loans for 100's of millions to build data centers...no problrm right? Is that the theme from Jaws? But thats not all; they're using the processor chips as collateral! Think how fast those lose value, add in a looming CRE/CMBS disaster we've mentioned many times, then consider that if they miss a payment the note-holder will have what recourse? Some outdated Nvidia graphics cards to repo. It's like they're purposely setting out to nuke the future economy. Perhaps to fuck long holders over? And retirees? And set them at each other? The only answer I can summon is that the powers think that the economy will end soon and are grabbing everything they can in a panic.

SubDRSive 6 months ago • 100%

The target is any industry that cuts costs. The terrorists are MBAs.

There should have been more crew. There should have been tugboats escorting the ship so an engine failure wouldn't endanger a public bridge.

They are externalising any possible cost and then spreading bs conspiracies.

The train that blew up in Ohio was less than an hour from Pittsburgh. If it it had happened there, how much damage and death would have resulted? Every us railroad is cutting costs, tearing up track the MBAs don't understand the immediate use for.

Anything happens, that's what the taxpayer is for.

Remember this shittiness when they're in prison. Faulty lights, expensive internet that's slow, fires, foul drinking water, etc. We need to constantly rub their noses in all possible cost cutting, while posting signs about how the prison is having a record year.

SubDRSive 6 months ago • 100%

I think some of the comments in this thread are interesting reading and underline the point in the OP.

https://old.reddit.com/r/Superstonk/comments/1bqqj4h/apes_whats_this_found_this_document_while/

www.standard.co.uk

www.standard.co.uk

OP is here...https://lemmy.world/post/13598257?scrollToComments=false "Money is flowing out of the London equities at a faster pace than ever, despite government efforts to boost the stock market. According to Investment Association recent figures UK savers took £14 billion out of UK equities last year, the eighth consecutive year of outflows. New research by SCM Direct for the Evening Standard suggests this situation is getting worse rather than better despite some experts insisting London shares are now so cheap they represent a buying opportunity. SCM looked at money flowing through Exchange Traded Funds, an increasingly popular tool for both small investors and large institutions. Of 17 European countries, only four – Austria, Norway, Germany, Holland – have seen greater percentage outflows of money this year. The largest UK equity ETF is the iShares Core FTSE 100 ETF which has a massive £14.8 Bn invested in it – this compares with the largest US Equities ETF worldwide, the SPDR S&P 500 ETF that holds $507 Bn in assets. Alan Miller of SCM Direct said: “Europe as a whole has seen money coming in not out. This is part of the reason for the abysmal showing of the UK market this year – the FTSE 100 is up just 0.2% vs +10.6% for the Euro Stoxx 50.” Miller adds: “There are some underlying fundamental reasons for the poor performance of UK equities, the over-representation in the ‘old’ economy i rather than tech, together with the ongoing uncertainties surrounding Brexit and its economic implications. Political instability, including changes in leadership and policy direction, has also contributed to a lack of confidence in UK equities. But this simply does not account for the gulf in performance and valuations between the UK and its peers.” One problem is that pension funds have just 4% of their assets in UK shares compared to 50% in 1990. This compares with Australia & Canada, both small markets, being 22% and 9% respectively of their pension funds. In fact, the pension fund that invests on behalf of Britain’s MPs and ministers, has just 1.7% invested in UK-listed companies."

SubDRSive 6 months ago • 100%

This trucking company rents the back panel of their curtainside trailers for advertising. Someone spent to get that printed and displayed, good on 'em.

SubDRSive 6 months ago • 100%

From superstonk...

"[–]IThatAsianGuyI🦍Voted✅ [score hidden] an hour ago They had a $319mil swing in terms of profitability while taking in almost $500mil less in the quarter.

That's actually wild."

***"Net income was $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022."*** FOURTH QUARTER OVERVIEW Net sales were $1.794 billion for the fourth quarter, compared to $2.226 billion in the prior year's fourth quarter. Selling, general and administrative (“SG&A”) expenses were $359.2 million, or 20.0% of net sales, for the fourth quarter, compared to $453.4 million, or 20.4% of net sales, in the prior year's fourth quarter. Net income was $63.1 million for the fourth quarter, compared to net income of $48.2 million for the prior year’s fourth quarter. Cash, cash equivalents and marketable securities were $1.199 billion at the close of the quarter. Long-term debt remains limited to a low-interest, unsecured term loan associated with the French government's response to COVID-19. FULL YEAR OVERVIEW Net sales were $5.273 billion for fiscal year 2023, compared to $5.927 billion for fiscal year 2022. SG&A expenses were $1.324 billion, or 25.1% of net sales, for fiscal year 2023, compared to $1.681 billion, or 28.4% of net sales, for fiscal year 2022. ***Net income was $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022.*** Adjusted EBITDA of $64.7 million for fiscal year 2023, compared to adjusted EBITDA of ($192.7) million for fiscal year 2022. The Company will not be holding a conference call today. Additional information can be found in the Company’s Form 10-K.**___**

SubDRSive 6 months ago • 66%

We aren't acquainted. I have read his posts sometimes.

Then noticed he was being "debunked" and attacked on a sub while on break earlier this year and thought it odd. Maybe I missed something? I don't go on Twitter, so miss things.

So I went to read his own site. I don't agree perfectly with all of his assertions, but un general didn't see attempts to undermine or divide. He likes researching and digging and connecting. All good things to me.

I am aware that his assertion that heatlamp is debunked may aggravate some, I think it's more nuanced than has been presented by "both" sides, and agree that it smells a little like a purity test.

If we're going to have actual discussions, I want to make way for others who keep open so they feel welcome. I don't have religion about theories, the truth will out and is my friend. Sometimes theories are a light held up that shines through previous misconceptions. But they are also not perfect.

First thing, many bought from brokers for a while. There was a severe resistance to DRS at first, and a lot of arguing and FUD.

Then came Book vs Plan, then more about how CS works...we're still learning and some stuff won't be truky known until it's hindsight.

If Plan isn't really DRS, why was I able to vote before I had mine all Booked? CS treated me like a stockholder.

I see it as vitally important to present accurate info if this place is going to be respected. We've seen what happened to Bets and to Superstonk and to PP.

If a person holds in Plan and can help vote to keep the board whole, I am not going to criticise theur choice. It's their life, their holdings, their comfort zone, their account.

I feel that I am not an expert here. I'm trying to jump start this place by bringing things I find for general consideration and interest, so that more people might see this as a resource and a non-scary place to post their own thoughts and questions, so we can all learn.

If I've misjudged this place and brought objectionable things like a cat bringing a dead mouse, please advise and I'll desist.

SubDRSive 6 months ago • 100%

And now someone's building a replica... https://www.maritime-executive.com/article/titanic-ii-the-ship-of-dreams-palmer-says-he-is-ready-to-move-forward

"Onboard passengers would be encouraged Palmer says to dress in period styles and partake in all the experiences of the Titanic of 1912. Among the offerings he says would be a recreation of the steerage dining room which served the immigrants aboard at long, communal tables and basic meals such as stew with mashed potatoes. (Modern food choices would also be available.) He also adds viewing platforms in the forward two funnels.

The famed movie starring Leonardo DiCaprio and Kate Winslet was a 1997 box office blockbuster and called the Titanic, “The ship of dreams.” "

Dreams isn't the word I would use for nocturnal considerations of such a vessel. I would be hoping to wake up and change the subject.

I am not an insider and have no secret info. That said, with the wind behind me going downhill, I have, in the past, been able to add 2 and 2, not going to reveal the answer I came up with, do your own calculating. Earnings is coming up in a week or so. For poor people, a question might be: Should one risk savings to buy further in? For those who don't even read Reddit or social meeja, note that it's been reported that GameStop revised their logo on Facebook recently. The red Stop part is now white, and the background is now black. I have no idea what is actually going to be reported, yet it is a particularly interesting change of logo colors to be made at this time, and could possibly be construed as a metaphorical indication by someone who is regarded. As always, one indicator of whether I've hit a nerve with my scattershot clumsiness is the presence of down votes to try to lower the post's position and hide it. Fortunately I'm beneath having an ego attachment to my posts, so down votes merely serve as an indication and mean nothing more. It's an easy way to test for veracity and being on-point.

SubDRSive 6 months ago • 100%

Also, if anyone finds out that they can't vote with Plan shares, please post about it.

I'm a Book person myself, but appreciate anyone who buys and holds, however they do it. The whole stock buying experience is a confusing mess, purposefully designed to separate investors from their funds, it makes cryoto look honest, so not looking down on someone for trying. I think it's great that this site tries to help.

I would like ti see DRS as the default, like it was when there were paper shares. Iirc, Australia does it by default now.

From a [superstonk thread](https://old.reddit.com/r/Superstonk/comments/1bb50dv/the_dark_pool_index_dix_collapsed_on_friday_dark/) explains short volume, seems credible... "to clarify: the dark pools did not collapse. DIX printed a 41.8% because retail got rug pulled.A high/big DIX value is usually consistent with future price appreciation, and a low/small DIX value is typically a bearish indication, though repeated data prints to indicate trend are going to be more reliable than a single print, just from a data perspective. The low print from Friday is just a confirmation that the selloff was mostly absorbed by retail. A large reason for why Friday dumped at all was because of the unstable options activity on NVDA: lots of call options got sold-to-close, a bunch of put options got purchased-to-open, and a bunch of OTM call options got sold-to-open. In aggregate, this created more selling pressure than there was demand to purchase shares of the underlying (NVDA, SPY, etc.) and so the market dumped in dramatic fashion. GME has a DIX too, it's usually very large (heh. nice.), and you can see it for yourselves by looking up the short volume off exchange (a public source of this data is at https://chartexchange.com/symbol/nyse-gme/short-volume/ ) But there's a few problems with these data: most of the posts about GME short volume that I see on this and other subs are written in a rage-baity way that completely misunderstands what these numbers even mean. High short volume off-exchange is a signal that institutions are buying shares of the underlying, so if you're a GME bull, you actually want to see big DIX / high short volume off exchange. Most people I've seen get mad at this because they don't know wtf they're talking about. CBOE put their short volume data behind a hefty paywall many months ago, and instead of reporting every day, they report at the end of the month. This makes it more difficult to use DIX on individual equities to try to determine market behavior. Fractional shares, for some reason, get reported as whole shares when it comes to reporting volume. All of these things dramatically muddies up the waters for trying to get a clear signal for what the market is doing"

It looks like the next SHF move will be to try to infiltrate and adulterate the board as a last-ditch end-run. In my understanding, Book and Plan shareholders can vote when the time comes. From comments I've read, Overstock did not have a lot of DRSed shares. Remember all the shilling against DRSing 82.5 years ago; they were...hedging. And setting up for this move. We beat them by DRSing our shares.

SubDRSive 7 months ago • 66%

I closed my blogs because of AI and search bots benefitting. I didn't want to work cheap for billionaires and it's obvious only corporations have copyright protection in the USA now.

No big loss, my words and photos weren't popular.

That said, if Dismal wants to post, I'll happily read.

SubDRSive 7 months ago • 75%

I generally agree. I certainty don't know everything or who is saying things for their own or other external reasons.

Dismal covers a lot of ground, so is perhaps a pro or backed by pros. Either way, it's stuff beyond my normal prowl and I'm free, so far, to think about it in any way I want.

I see the statements made by GME corporate as corporate statements.

SubDRSive 7 months ago • 62%

It's all his work, I just pasted it. He's doing a smart thing, putting his work on his own site. No shils, no mods, no spam.

dismal-jellyfish.com

dismal-jellyfish.com

"TLDRS GameStop Rejects Shareholder Claims, Debunks Heat Lamp, and Fully Supports 'Plan' For Shareholders. GameStop states these allegations by the Proponent are speculative and lack factual evidence, misleading shareholders about the integrity of the Company and its DirectStock Plan. GameStop goes on to say the connection between the DirectStock Plan's recurring purchases and the alleged market manipulations is not substantiated, casting doubt on the relevance of these claims to the shareholder vote. GameStop and Computershare assert that recurring purchases are intended for market transparency, not for facilitating any illegal activities." Edited for clarity that it's Dismal's work. I obviously don't know how to use Lemmy's quote feature. EDIT2, Dismal has more about himself and his work here...https://dismal-jellyfish.com/who-what-where-why-when-of-dismal-jellyfish-com/ "There is no wrong way to hold GameStop. PERIOD. FULL STOP. Even holding a SHORT position (not illegal naked shorts) should be celebrated--that is a FUTURE buyer of the stock on the run up to being launched to Uranus. If you hold GameStop, or are new and interested in learning more we are good--we have enough in common to build on a foundation of respect and learn together. Everything else is just window dressing at the end of the day--some look and are better quality than others (DRS vs buying and holding with a broker), but unless and until the current system burns to the ground and is rebuilt with smart contracts, holding GameStop anywhere is all it takes to be on this 'team'." Und so weiter...

Not cereus, Sat morning fun...offerng the Peruvian Bull some alfalfa. Why is the US government fighting a company that wants to enter the radio room of the Titanic wreck? https://www.maritime-executive.com/article/titanic-imaging-expedition-set-for-may-despite-u-s-government-opposition "At the center of the objections by the U.S. is the company’s plan to use the expedition to access the Marconi room of the ship that played a crucial role as the vessel sank. The room contains the wireless telegraph equipment that sent possibly the first-ever SOS Morse code message. Not only detected by nearby vessels. the signal was relayed to the United States providing the first news of the tragedy." Foil crinkling... 3 of the 4 richest men in the country, at that time, all opposed the federal reserve founded in 1913 - all died on the Titanic in 1912...John Astor, Benjamin Guggenheim and George Wick One theory is that it was actually the Britannic, which had been damaged at the dock and which they sank for insurance, knowing that it would break apart eventually. Would there be an identification plate or log in the radio room that shows it being the Britannic, left there because no passenger would likely see it? Didn't someone we know tweet a line from a certain movie about a ship disaster?

www.theregister.com

www.theregister.com

After being unable to see SHFs legal failures, SEC bravely picks in a failing e-truck company that one of its friends probably lost money on...dig the reprehensible irony of that last line... "We allege that, in a highly competitive race to deliver the first mass-produced electric pickup truck to the US market, Lordstown oversold true demand for the Endurance," said Mark Cave, associate director of the SEC's Enforcement division. "Exaggerations that misrepresent a public company's competitive advantages distort the capital markets and foil investors' ability to make informed decisions about where to put their money."

SubDRSive 7 months ago • 66%

I felt immediate concern after seeing that photo. For him, not my tiny investment. I've gotten to know a bit about him via his actions and writing through this, he has a lot more to offer than CEO work.

Reading into the telenovela familia on odd subs, there are supposedly two plans for bbbyq going forward, one which could happen at any time, except *now* apparently. And one involving DOJ and possibly wrapping at the end of the year. Selfie showing ghostly-exhausted RC with the builder concerning. I have sometimes felt impatient but imagine him struggling like a man tied up under a bridge while people up on the deck are parrying and talking nonsense, unmindful of his strenuous effort. Cifu the combative turns querulous as looming things enlarge and throw shadow. Perhaps canary moment? I think we are at the question if when the perfect becones the enemy of shareholder delight. But my dog is small and may not make it either way.

lemmy.ca

lemmy.ca

Brought the whole thread so you can see what the uninitiated are thinking. "The volume of delinquent commercial mortgages held by US banks soared to $24.3 billion last year, up from $11.2 billion in 2022."

SubDRSive 7 months ago • 100%

I overwrote all my posts with that automated thing and they put them back and sent me a dm about it.

I meed to try again.

The deal with Gargle has been in place a long time. Ifa user triesto access the site with any other briwser, a pop up suggests the app or chrome.

But of course our elected officials came from the era of hand crank wooden phones on the wall and asking for an operator, so I might have to start a tech company myself with all these no rules and regs in the way. Cmon in and help yourselves to our citizen's data.

SubDRSive 7 months ago • 100%

That was the impetus. The subs backed off on being minatory, possibly for retention.

And note that subs other than wallstreetbets are not being mentioned. Tightrope walking going on at reddit HQ.

I'm seeing an obvious and expensive endgame here, including trying to sell reddit baggage to its users without giving them power. There's /superstonk, the killed /ppshow crowd went back to /bbby, there's /teddy, Dr T is now on /householdinvestors...how many know about this place as an alternative and can it stay up if they show up?

Bbby earnings due 24th per previous years.

"21 banks have crossed a dangerous threshold on their commercial real estate (CRE) loans, raising concerns about the state of America's commercial real estate. According to Bloomberg data, the affected banks include Valley National Bancorp, WaFd, Axos Financial, BCI Financial Group, and First Foundation. While these banks aren’t exactly household names, they each hold between $13 billion and $61 billion in total assets. In the case of Valley National Bancorp, the CRE portfolio was a whopping 471% of its total capital. “We’re at the warning stage,” said Keith Noreika, former acting comptroller of the currency. “There’s a light going off on the dashboard and now people are opening up the hood to see: Is it really wrong or do we just need to keep our eye on it?” Last year, the Fed, FDIC, and Office of the Comptroller of the Currency established a standard that would help regulators identify banks with high-risk CRE loans."

Prescient Peruvian Bull strikes again... Lemmy post...https://lemmy.world/post/12132525 “Argentina registered a year-on-year inflation rate of 254.2 percent in January, the highest in 32 years, according to data released Wednesday by the National Institute of Statistics and Censuses (INDEC)” Poorness rise to almost 58% while the president is refusing to hike the minimum wage, which is common to rise every 3 months or so even during the right wing liberal regime of Macri, but this guy FUCK NO he just signed a billion dollar subsidy to “Mercado Libre” the eCash monopoly owned by the richest Argentinean Galperin ~5 Billion of declared wealth"

www.theguardian.com

www.theguardian.com

Who could have predicted this turn of events?

SubDRSive 8 months ago • 100%

It disrupts startups by rearranging the words.

Geesh, it's obvious.

SubDRSive 8 months ago • 100%

Not upvoting the sentiments in the letter. Alphabet overhired fot years to shade out startups from finding techs, now that everything is being stripped for value the vulture capitalists gave arrived.

If they hadn't been such assholes about data slurping there might be positive public sentiment, but no, bridge with techies burnt.

Capitalist plan for destroyed planet is? Bribe the sun? Oooh, a bunker /tomb in Hawaii! Flex flex Obvious none of these people have faced physical reality outside an office, they want to live forever without a supporting planet around them.

Just wear our 3000 dollar goggles and things will look fine.

SubDRSive 8 months ago • 100%

Nice work!

I tbink we need to list the media outlets and their owners in a post somewhere.

SubDRSive 8 months ago • 100%

If Apple started trying to shed employees while pretending not to, say by forcing RTO and moving jobs to Texas...but no, unthinkable.

RC is a holder, what might that do to GME? Will GME sell Apple products some day?

www.sfgate.com

www.sfgate.com

https://www.sfgate.com/local/article/sf-centre-mall-value-loss-18611485.php "A December appraisal by research firm Morningstar places the mall’s current value at $290 million, according to The Real Deal. That’s a massive haircut amounting to a nearly $1 billion decrease from its 2016 value of $1.2 billion. The mall’s troubles reached a peak when Westfield and partner Brookfield Properties turned the property over to their lender in June 2023, defaulting on a $558 million loan. The former mall operators blamed decreased sales and low foot traffic for their departure..."

Edwin twitter thread via Nitter. I know it's quiet here, I think this is worthy of caching away from reddit.

www.theguardian.com

www.theguardian.com

"Citi currently has 239,000 staff across the world. The lender plans to reduce this by 20,000 as part of a reorganisation, Mason said. Executives ultimately expect the workforce to shrink to about 180,000 employees, as the upcoming listing of Banamex, Citi’s Mexican consumer division, is also set to reduce staffing levels by about 40,000. As the latest quarterly earnings season got under way on Wall Street on Friday, Citi posted a $1.8bn loss for the fourth quarter, after recording a string of one-off charges and expenses – $3.8bn in total – tied to its restructuring, retreat from Russia and exposure to Argentina."

www.investopedia.com

www.investopedia.com

The order audit trail system (OATS) is a computerized regulatory mechanism that maintains detailed records of securities transactions. OATS requires member firms of FINRA to automatically record and report orders to FINRA.1 OATS was established so that orders could be more easily tracked and reviewed if necessary; for instance, in the case of a trading error or suspected market manipulation. Individual traders and investors are not required to provide OATS data to FINRA. This is the job of the broker or member firm handling client orders. https://www.investopedia.com/terms/o/order_audit_trail_system.asp

SubDRSive 9 months ago • 100%

Everything up is East.

SubDRSive 9 months ago • 100%

Reminiscent of crypto in some way.

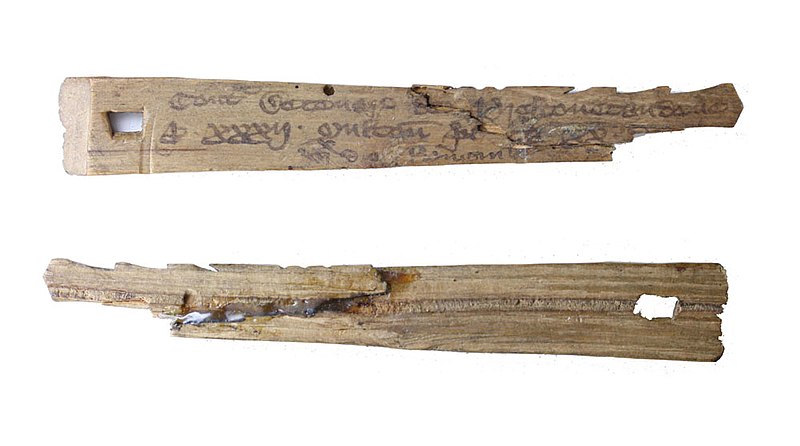

www.futilitycloset.com

www.futilitycloset.com

These notched sticks were more real than today's shorts. "Until 1826, the British Royal Treasury recognized notched sticks as proof of payment. In a practice that had begun in medieval times, a debt would be recorded on a “tally stick,” and then the stick would be split lengthwise, with the shorter portion, the “foil,” given to the debtor and the longer portion, the “***stock***,” held by the creditor. Because the two halves of the stick could be matched together, this gave both parties a record of the deal, *and the valuable stock could then be traded on a secondary market"*

SubDRSive 9 months ago • 100%

I have a problem with that. It makes me feel like I'm being sold like a specimen in a Petri dish.

Not informing users that they're being sold out is and was insulting and rude. And you didn't even get enough to build your own tomb like Zuck is doing with great public-spiritedness.

Well, enjoy the exodus as yet another online ideal gets eroded by greed.

So far 2 Masto, a Pixel, and a Lemmy are done for me.

I didn't sign up to work free for billionaires.

SubDRSive 9 months ago • 80%

I was indeed referring to Meta.

Here's an article about the Dropbox imbroglio... https://www.theregister.com/2023/12/15/dropbox_ai_training/?td=rt-3a

It includes these paragraphs...

"That could have been the end of it, but for one thing: as noted by developer Simon Willison, many people no longer trust what big tech or AI entities say. Willison refers to this as the "AI Trust Crisis," and offers a few suggestions that could help – like OpenAI revealing the data it uses for model training. He argues there's a need for greater transparency.

That is a fair diagnosis for what ails the entire industry. The tech titans behind what's been referred to as "Surveillance Capitalism" – Amazon, Google, Meta, data gathering enablers and brokers like Adobe and Oracle, and data-hungry AI firms like OpenAI – have a history of opacity with regard to privacy practices, business practices, and algorithms.

To detail the infractions through years – the privacy scandals, lawsuits, and consent decrees – would take a book. Recall that this is the industry that developed "dark patterns" – ways to manipulate people through interface design – and routinely opts customers into services by default because they know few would bother to make that choice.

Let it suffice to observe that a decade ago Facebook, in a moment of honesty, referred to its Privacy Policy as its Data Use Policy. Privacy has simply never been available to those using popular technology platforms – no matter how often these firms mouth their mantra, "We take privacy very seriously.""

I do not intend to have an involuntary Meta account.

finance.yahoo.com

finance.yahoo.com

Yahoo link, but to bloomberg article that's prob paywalled. Posted on supa but being voted to oblivion. "Reports that Citigroup was deciding whether to exit a business it once dominated shocked the municipal market earlier this year. For decades, the bank was a powerhouse in the $4 trillion market for US state and local debt, helping on landmark projects including the rebuilding of the World Trade Center site and the installation of 65,000 streetlights around the city of Detroit."

SubDRSive 9 months ago • 100%

Look where you are right now. Reddit won't allow users to even name Lemmy so we can tell them where we are.

Do you think Meta might do the same at some point?

Could this be yet another attempt to contain and control us?

This is a "let's just invite Professor Lechter over for dinner, he seems like a friendly fellow" moment for Lemmy and the Fediverse.

Admins of each instance can choose which other instances to federate/share your info with.

Here's the convo on lemmy.world... https://lemmy.world/post/9527528?scrollToComments=true

The whole thing is there, submitted for your approval. If anyone recognizes shills by now, it's us.

Please advise.

SubDRSive 9 months ago • 100%

There are peooke who never actually learn about tech, so everything must always be in the same place.

Personally, they can stay where they're at if they're at that level of world interaction.

Lemmy has roughly the same functions as anywhere else, just in different arrangement. If someone can't see that, what are their other perceptions like?

SubDRSive 9 months ago • 100%

And now they're federating with Meta's sewage operation, so I may not be l9ng with the fedi.

Tech bros are like a lice infestation.

SubDRSive 9 months ago • 57%

Let's ask part of the problem for a solution.

SubDRSive 9 months ago • 100%

This is the way, keeping channels open and helping people find this one.

SubDRSive 9 months ago • 100%

Amended, thank you.

SubDRSive 9 months ago • 100%

There is also a ppshow venue on Lemmy... !theppshow@lemmy.world

An account here should also work there.