Sidebar

WhyDRS

**[Why DRS?](www.whydrs.org)** WhyDRS.org is a free educational resource about the financial markets in the United States, and specifically regarding direct registration, a method of personal ownership available to everyone but rarely used. The vast majority of publicly issued stock are owned by a single entity called [Cede and Co](https://en.wikipedia.org/wiki/Cede_and_Company). Investors can choose to keep company stock in their own name using the Direct Registration System - which provides multiple benefits and safeties not available with other methods of holding. WhyDRS.org is run by volunteers as a service to the worldwide investing community and monetary donations are not currently being accepted. Time and effort donations are extremely welcome and appreciated - more details in the 'How can you volunteer?' section below. **What resources does WhyDRS have?** WhyDRS.org is an information and advocacy hub which hosts 1. A variety of information about Direct Registration and the markets such as the [WhyDRS Information Packet](https://www.whydrs.org/the-whydrs-information-packet) which details the benefits of Direct Registration, a collection of [articles and deep dives](https://www.whydrs.org/learn-more), and an extensive [glossary of financial terms.](https://www.whydrs.org/glossary-of-terms) 2. Advocacy resources including the [SEC Comment Submission Tool](https://www.whydrs.org/submit-sec-comment), a per-issuer [Contact Investor Relations Tool](https://www.whydrs.org/contact-investor-relations), and graphic design resources for either [personal use and guerilla marketing](https://www.whydrs.org/free-resources) or premade items are [available at a 0% profit online store](https://whydrs.myspreadshop.com/). 3. A robust [Direct Registration Request Template](https://www.whydrs.org/drs-request-template), which allows an investor of any stock and with any broker to get quick access to important information (such as transfer agent or expected fees) so that they are fully prepared to initiate their DRS transfer. 4. (In Development) Landing pages with unique URLs for transfer agents, issuers, and brokers whose database entries are filled in and complete. Under the surface, it's the WhyDRS Database which powers many of the above tools and will power planned features to come. As the database grows through volunteer input, the power and reach of all tools on the site grow with it in real time. **What is the WhyDRS Database?** DRSGME.org found success focusing on providing DRS information on a single ticker (GME) and their transfer agent (ComputerShare). WhyDRS wants to include all publicly traded companies, and therefore all transfer agents, as well. There are thousands of publicly traded companies registered with the SEC – and while data about them is publicly available, it’s hard to find a single resource which provides free access to an array of detailed company data. That’s where WhyDRS can change the game – by providing a non-monetized and completely public resource for retail investors to find out information about any public stock, including investor relations information such as transfer agent procedures. You can view the database here: references.transferagents.eth.limo or here: https://docs.google.com/spreadsheets/u/2/d/e/2PACX-1vSej0xJPYfkVeQGVBc1CZbcie9jCXNnwcU0l1szJaXdPZU0XhQli5sMgjdmmGZE32uZc6QBiELzRo9N/pubhtml?gid=1544430281&single=true We’ve prioritized completing information for the most traded companies, such as those in the S&P 500, first. This will allow for the database to have a running start in helping retail investors with popular interests. However, in terms of total data - there is a long way to go, and we’re looking for help. Please take some time to help build this database! **How can you Volunteer?** There are several ways you can help. 1. Enter company/broker/transfer agent data one at a time. We’ve prepared multiple online google forms which can be used to submit data. Supplying an email address / having a Google account is not required. Data won’t be immediately added to the spreadsheet. The forms have a section for a reference or source, and we’ll be verifying data as it comes in. Database Contribution Google Forms: [Issuer Submission Form](https://docs.google.com/forms/d/e/1FAIpQLSeYbRsNLz7aIsCjUHHm-JwSY3a4E7zCzFnG0A4tew9t4eK7yA/viewform) [Investor Relations Email Submission Form](https://docs.google.com/forms/d/1mASDRXHE9JhZa7jgpvxSj58lxIKbSIXUtjswcaweBto/edit) [Broker Submission Form](https://docs.google.com/forms/d/1nzzHzUmQaFRdH9MMrlsLcWAsAO3K5Brt8Te7xxABngw/edit) [Transfer Agents Submission Form](https://docs.google.com/forms/d/1ezhOxnz-KHFd7FLrHcwwt13UvVTkF1MBFptVZlJLeVE/edit) 2. Seek resources we can extract data from in bulk to add to our spreadsheet. For example: We were able to find a database in CSV from NYSE which detailed a lot of info on companies which trade on that exchange and import much of that data to our formatting. If you don’t want to submit data with the above method, you could search for resources like this. A similar CSV for NASDAQ would be a huge help to find. If you find something useful, you can post about any resources you find here or email us at hi@whydrs.org. 3. Spread the word about this volunteer project! The WhyDRS Publicly Traded Companies Database is a resource for retail investors everywhere who want simple and easy access to detailed information. The more people who help out, the more quickly this resource can grow and be more useful to other investors worldwide. It's a huge undertaking, but the benefits will be even more bigger. All of the resources and tools mentioned above are informed through this database, and will all improve in real time as more data is added and the existing data is refined. Thanks so much for being here, for reading, and for helping catalyze the shift towards personal ownership. Changing the world is what’s at stake!

All links in the document have been archived. It contains no financial advice.

https://www.reddit.com/r/GME/comments/1cpkrt0/superstonk_needs_to_allow_the_original_heat_lamp/ It's become so well known and now that multiple experts are weighing in and saying it's possible, the SS mods are trying to sweep it under the rug by saying it's an "already known" DD that doesn't need to be rehashed. Excuse me, but what the fuck? The SS mods caused so much harm to the ape community over this. They silenced people, they banned people (including me) and thus slowed down the flow of shares going to pure book that could have caused MOASS so much sooner. Not too long ago platinumsparkles made a nonsense post taking part of a GME earnings call out of context and tried to say heat lamp is dead. I called her out on it, and of course she never retracted her statement or apologized. If they now acknowledge the fact that heat lamp is valid, they need to unban everyone they banned for posting heat lamp, and apologize for all the harm they caused. platinumsparkles also needs to step down. She has been the most rabid mod attacking heat lamp and she is personally responsible for causing most of the harm.

It's been a very active week as many of us turn to WhyDRS with increasing fervor. 🤝 From what I've seen, that means more time, effort, and thought put into our next steps. There's a long road ahead, as we've all discovered these past few years imo. Incredible to think how much we can all accomplish together. 🛤 I'm trying out this new format as a way to efficiently respond to interesting recent thoughts. Let me know what you think per [attempts to streamline involvement](https://discord.com/channels/1102309240145707049/1221274503821131797/1222265778376544327). 💬 It seems I've been [missing](https://x.com/JFWooten4/status/1785641217805459492) material [discussions](https://lemmy.whynotdrs.org/post/1395252) with my existing approach of some quick time each week to glance over main insights. >This kind of work is a(n unpaid) full time job. I dont expect anyone to stay up on all of it all the time unless they’re deeply entrenched in the day to day. — [wtfeweguys](https://discord.com/channels/955819881989808128/1068991643828633732/1236392978583519262) Hopefully this new format will help organize otherwise disparate thoughts in a central place. All around, I appreciate community members who help organize new information by [mentioning me](https://discord.com/channels/1102309240145707049/1221274503821131797/1221485041498984619) when relevant. Your DMs, [timely references](https://discord.com/channels/955819881989808128/1068991643828633732/1236392509718921276), and [public conversations](https://www.listennotes.com/podcast-clips/taking-stock-episode-24-tracking-direct-plan-eZ5RjFUK3Pm/) mean a lot and help organize pending thoughts. 💭 --- # Background Relevant to this new discussion medium is the evolving structure of Discord conversations. 🗣 Half of the chat links above come from a private "internal team" server rather than the public Discord. Moreover, (future) community members frequently discuss important web3 governance topics [across](https://discord.com/channels/897514728459468821/1082054027317096478/1225404545241448479) [the](https://discord.com/channels/1042985282531766353/1219894740279885835/1227038372799709224) [web](https://www.youtube.com/post/UgkxZLBI2YL9j0ldcVjphleyBrleTz5VXPJ2). 🌐 As some community members have voiced these last couple weeks, much of our work can feel like shouting into a black hole. 🌌 As someone with twice as many [YouTube](https://www.youtube.com/jfwooten4) videos than subscribers, I'm right there with you. Ideally, more sharable documentation like this will help spread our [important messages](https://www.marketliteracy.org/) at scale. While we've been diligently promoting our ideals, this next chapter of newfound organization might renew our passion, direction, and influence. ✊ I won't pretend to know exactly where all this goes. That's [for all of us to decide in concert](https://discord.com/channels/955819881989808128/1221128163384623114/1221132458745921676). 🧠 But we had a great start with our conversation last week on [Taking Stock](https://linktr.ee/takingstockpodcast) and in the biweekly [internal dialogue](https://discord.com/channels/955819881989808128/1194680207207059537/1235422980977328189) thereafter. 🎙 And hopefully these responses promote a permissionless, transparent, and direct [governance system](https://discord.com/channels/1102309240145707049/1231401381441568778/1237441982960369806) that's easy for anyone to reference, search, and chat around. --- # 1. Regulation of Transfer Agent "Plan" Services Firstly, we've been talking about important nuances in DSPP and other Plan custody schemes for months. I'd like to draw attention to the legal [plan definition](https://www.law.cornell.edu/definitions/index.php?def_id=9d243016b094305eb1f0d06587e0caf6) and SEC thoughts on their regulation: >Transfer Agents [with plans] all provide some level of transaction execution and order routing services. >Netting is a function commonly performed by clearing agencies and may also be performed by broker-dealers for customers holding in street name, but is not among the core functions enumerated in Exchange Act Section 3(a)(25) performed by registered transfer agents. Hence, netting and other execution services may not themselves implicate transfer agent requirements, but nonetheless may trigger broker-dealer regulatory requirements. >"Effecting securities transactions" includes, among other things, identifying potential purchasers of securities, soliciting securities transactions, routing or matching orders, handling customer funds or securities, and preparing and sending transaction confirmations (other than on behalf of a broker-dealer that executes the trades). >Receiving transaction-based compensation may also indicate that a person is effecting securities transactions for the account of other. >The Commission has brought enforcement actions against transfer agents operating as broker-dealers without registering as such with the Commission. For example, the Commission found that a transfer agent was acting as an unregistered broker-dealer in violation of Exchange Act Section 15(a) when it, among other things: opened accounts for individual retirement account ("IRA") customers > Furthermore, a transfer agent that effects securities transactions for investors in connection with administering certain types of Issuer Plans may be engaging in broker activity. > — SEC File No. S7-27-15 Relevantly, the most recent staff guidance on what transfer agents can and can't do in terms of direct trading involvement boil down to a handful of [no-action letters](https://www.sec.gov/files/rules/exorders/2006/34-53667.pdf) issued largely before the turn of the century. It's been very difficult to revisit the topic given the advent of blockchain technology. ⛓ This is why I think transfer agent regulations have sat on the SEC's docket for nearly a decade after the release referenced. ⌛ This is not an easy question as it requires a complete rethink of the origination and processing of transactions from the basis of shares in your own name. For instance, we've discussed [historic services](https://www.sec.gov/comments/sr-dtc-2006-16/dtc200616-39.pdf) providing direct market access [at](https://discord.com/channels/1102309240145707049/1102309240741310503/1208904390312988673) [length](https://discord.com/channels/1102309240145707049/1231401381441568778/1237260786804461610) over over the past two months. 📜 Much of this conversation ultimately comes down to the crux of our problems: the DTCC as a monopoly marketplace. And this particularly starts to [matter](https://discord.com/channels/1102309240145707049/1231401381441568778/1237441982960369806) given their [de-facto regulatory role](https://www.sec.gov/comments/sr-dtc-2006-16/dtc200616-32.pdf)—which may or [may not](https://discord.com/channels/1102309240145707049/1216793196538101823/1220470529002311820) be constitutional. ⚖ All this is part of why governance matters so much to TAD3. When you can [directly trade without middlemen](https://www.blocktransfer.com/blog/post/investor-to-investor-direct-trading), the line starts to blur on exactly a transfer agent [can and can't do](https://drive.blocktransfer.com/show/external/publish/6e0mme8b654e4f87a4414aa65f81ecbb53fc5). 🤔 And I think the best people to define that boundary are investors themselves [officially](https://discord.com/channels/1102309240145707049/1229803464314585129/1230523702324760687) or [directly](https://discord.com/channels/1102309240145707049/1102309240741310503/1191565884993576970). --- # 2. Blockchain and Direct ETFs >DRS doesn't solve the ETF problems. >ETFs can still create and redeem without the asset being available. That's the problem. >Even if we DRS Book the whole float, ETFs will still trade with GME in them, legally too. — [Born Luckiest](https://discord.com/channels/955819881989808128/1068991643828633732/1236306721471725568) I'm not entirely sure what you mean in terms of the legacy ETFs still trading with GME since if we DRS all the shares than in theory those holding companies should have to get their shares from a directly-registered source. So in that case it seems you would just be pushing institutional adoption of direct holding, which could of course lead to outflows from DRS. 🔀 There's some nuance there, and I'd like to talk more about some other corner cases community members had about TAD3 on a Taking Stock AMA sometime. The implications may be [hidden or third-order](https://discord.com/channels/955819881989808128/1068991643828633732/1236391115477880975), but I think the details matter. 🗨 Stocks on chain fundamentally reimagine how we engage with ETFs, introducing a level of granularity in ownership that traditional methods simply can’t match. Picture an ETF not as a bundled package sold under a single ticker, but as a direct, real-time portfolio of individual assets on a blockchain. 🔗 This vision allows investors to own and trade fractions of the actual assets within an ETF without intermediaries or the need for bundled products. 👀 ## 2.1 Elimination of Management Fees In traditional ETFs, management fees are charged to cover the costs of managing and operating the fund. However, with direct ETFs on the blockchain, each asset can be bought and sold individually without the need for a fund manager. This setup removes the management fees typically associated with ETFs, as investors manage their investments directly through their digital wallets, interacting with the market on a peer-to-peer basis. 💻 ## 2.2 No Premiums or Discounts Traditional ETFs can trade at values that deviate from the net asset value of their underlying assets, either at a premium or a discount, influenced by market dynamics and liquidity concerns. With blockchain-based direct ETFs, investors purchase tokens that represent actual ownership of the underlying assets. 🎯 This direct linkage ensures that the trading price of these tokens is aligned with the real-time value of the assets, not affected by the speculative pricing often seen in traditional ETF markets. ## 2.3 Personalized Rebalancing Blockchain facilitates a high degree of control over investment portfolios. Investors can adjust their asset holdings in real-time to align with personal financial strategies and goals, without waiting for the ETF provider to make quarterly or annual adjustments. This control allows for dynamic portfolio management, enabling investors to respond quickly to market changes or shifts in their investment outlook. 📈 --- # 3. Ongoing DAO Organization >[nonprofit advocacy organizations] don't exist yet, the structure only becomes legally possible on 7/1/2024, so I couldn't point you to an official one that is legally recognized. — [LastResortFriend](https://discord.com/channels/955819881989808128/1207198663202316338/1236314433127710750) We've discussed the importance and material implications of building a distributed governance structure for the ape movement behind closed doors for a while now. I believe this is the materialization of a true market reform in the making. Namely, this community is one of the first groups I've heard of working with a pure intention to create a better [public system](https://digitalpublicgoods.net/digital-public-goods/) for everyone to manage their assets. As a nonprofit should be: >there’s no distributed ownership/economics element to it. I’m pointing out there’s no ownership/economics to it *at all*. — [wtfeweguys](https://discord.com/channels/955819881989808128/1059557502183800972/1138465617222041723) ## 3.1 Documenting Journey Starting as a loosely organized advocacy group on Reddit, our community has grown into a more structured ensemble on Discord, allowing for deeper and more focused discussions. This transition was not just about changing platforms but about evolving our methods of engagement and decision-making to better suit our growing needs and objectives. The community has successfully organized with major innovations from finding good meeting times across time zones to facilitating bulk distributed work on a quality centralized database. ## 3.2 Open Source Development Recognizing the need for a collaborative and transparent development environment, we may consider turning to GitHub. This platform allows us to not only host and review code but also to manage specific TAD3 projects and documentation effectively. It's here that we can begun building the components of an open-source securities trading and settlement ecosystem, leveraging the collective expertise and enthusiasm of our community. ## 3.3 Universe Panel Sharing To further our understanding and refine our approach, might we consider hosting a panel discussions that brings together experts from our community. These discussions could prove invaluable for sharing knowledge, challenging our assumptions, and drawing lessons from our DAO successes and setbacks. It's essential to document our progress through detailed roadmaps and public events imo. These deliverables serve not just as planning tools but also as historical records of our journey. They help new members understand our evolution and ensure that our goals are aligned and clear. --- # 4. Figurehead of Sorts > No one is comfortable being that central leader, so the roadmap and structure fill the role enough for a few people to pass it around. — [LastResortFriend](https://discord.com/channels/955819881989808128/1207198663202316338/1236319836502757548) I believe there are some [material risks](https://www.youtube.com/watch?t=5272&v=rbjFjda3_UI) in leading this movement given the vested interests, bad actors, and material disruption TAD3 or a similar system [introduces](https://www.linkedin.com/pulse/step-function-innovation-myth-overnight-success-john-wooten-akl7e/). Ideally, Block Transfer itself can field most of any legal challenges that arise from disrupting Wall Street. 🏛 In terms of a speaking head in public, I'd be happy to throw myself in the ring. The GitHub event could be a good starting point. I'm more than happy to put more time into content like this if it's materially sustainable. 🌱 It ultimately comes down to what the broader community wants in terms of speaking for yourself v. having a reliable representative ready to promote necessary ideological advancements. 🎓 What we're building is more than just software, recordkeeping, or business services. It's a fundamental rethink of capitalism that's that "nail in the coffin" of Wall Street complementing the "hammer" of effective advocacy. 🔨 In my view, that also means a complete rethink of system governance to enable a longstanding replacement piece of public infrastructure. 🔩 --- # 5. Proxy Voting Email Manipulation Per [our official writeup](https://www.drsgme.org/2024-agm-emails): > Undetected suppression is difficult and probably reserved for higher ups. It seems too deliberate to be accident — [6days1week](https://discord.com/channels/955819881989808128/1059557502183800972/1236346776810815518) Firstly, exceptional efforts bringing this to light on X [through](https://x.com/6days1week/status/1786024585961340953) [detailed](https://x.com/6days1week/status/1786084841164886117) [posts](https://x.com/6days1week/status/1786398728401654038). 👍 Tremendous job getting primary sources collected and disseminated exposing potential ulterior motives driving profit interests above effective governance. While the regulations around traditional paper systems v. online communications are thorough, this kind of deceit is unfortunately not yet illegal per any mailing [codifications](https://www.law.cornell.edu/cfr/text/17/240.14a-16). 📬 Having designed our email notification system for proxy distribution, I agree that this is highly unusual. 🧐 As shown with virtually all other companies, these emails are supposed to be standard variable changes and nothing more. 🤖 It's almost always the exact same format with merged fields for every other stock. The only reason in my view for this kind of tomfoolery is that they are hiding something. Per recent inquiries on other transfer agents, I'll reiterate that I don't like to speak poorly of legacy agents since the true enemy here is the DTCC per [Taking Stock](https://linktr.ee/takingstockpodcast) #16. Rather, might we all just collectively develop and standardized system and take first action as the inaugural Transfer Agent Depository? 🧮 --- # 6. Private v. Public Markets > Would be nice to find a continuously updated list of companies that aren't public anymore (due to going private, acquisition, merger, or bankruptcy) but I didn't see anything like this — [gorillionaire2](https://discord.com/channels/955819881989808128/1054094702904881213/1228904857348472904) Hopefully the issuers.info API solves many of these challenges. But I'd like to call into question what exactly we mean with public v. [private](https://privates.jfwooten4.com). The application legally here has to do with primary offerings and specifically what kinds of investors a company can sell stock to. 💵 But that's not the whole picture in an ongoing efficient market system like TAD3. Namely, the system is built to enable anyone to trade after statutory limitations around holding periods. In English, that means anyone can sell their shares to anyone else after a year or less, in America at least. 💱 The trading itself as referenced earlier via the SDEX per [open protocols](https://github.com/blocktransfer/yellowpaper) thus enables widespread trading whether or not a company is "public." ## 6.1 Public - What Does it Mean? From the perview of the SEC, a public company means an EDGAR filer subject to Section 12 or 15(d) of the Securities Exchange Act of 1934. While that might sound technical, it is just the same set of reporting standards you're used to seeing around quarterly and annual reports. 📰 And the regulations themselves have statutory thresholds for when you must start filing documents, such as reaching over 2000 investors. 🕵️♀️ Interestingly, our regulations themselves have little to say about any statutory requirement to have securities trading through intermediaries themselves. ## 6.2 Private - Can You Still Trade? For instance, consider that I have a private company, [MonerAds](https://www.youtube.com/playlist?list=PLWUFvhKuc_5tVzjb1xXSnpVx0E42K3nQD). I sell you some shares, which become tradable in a year under Rule 144. Now you sign a contract with Joe Public transferring the stock in exchange for $X cash. 💼 This private transaction, valid under basic anti-fraud law, creates a small market for my private company's stock, even though I never met with or offered securities to Joe Public. And now that Joe has unrestricted shares, he can sell to whomever he wants, and so on. 📑 ## 6.3 TAD3 - Blurring the Lines All the assets Block Transfer acts as agent for can trade along these lines, on the basis of quality widespread transparent public information. The overall accounting system, built on Stellar, is the same fundamental technology for all underlying assets, peers, and jurisdictions. 🏳 Our central role comes in just to manage the ongoing nuances of international compliance, primary placements, and protective regimes. So, when the difference between private and public is simply who the company can sell stock to, do widespread direct investor markets inherently place all companies on the same playing ground of direct capitalism? 🚀 --- # 7. Real World Demonstrations > [community member] wants more boots on the ground work, and honestly I'm fine with him being a team leader on stuff like that. It's not what I do, it's what some others are interested in, but don't have experience in where to start. I think part of the issue is most of us in this discord are researchers and makers... I've always seen this group as various departments with team leaders, but never one central leader... I think getting the 501c going will help bring in funding, which we need for the advocacy efforts. And the DAO is the most reflective way of how we operate. — [Bibic Jr](https://discord.com/channels/955819881989808128/1207198663202316338/1236401955027423302) Not sure if demonstrations is the right word here, since it seems a lot of our work is slowly undoing very nuanced legal frameworks designed to put the money of the masses in the pockets of a few Wall Street insiders. 👔 But aside from that, if we want to do more live demonstrations, I'd also be happy to help and rally support using any means available. I love that the SEC does remote virtual meetings, allowing more diverse perspectives from community members that might have neither the time, resources, nor inclination to travel to D.C. like traditional lobbyists for instance. 📞 --- # 8. Selling Our Ideas > I think everyone here understands the value of marketing. — [6days1week](https://discord.com/channels/955819881989808128/1207198663202316338/1236421358754467953) As I disused privately with Chives [here](https://discord.com/channels/955819881989808128/1221128163384623114/1231998507343155342), I've also been down the [marketing hole](https://www.youtube.com/watch?v=md_EWTLmgjc&list=PLWUFvhKuc_5u3hvR4LquRZkZgWZzwkbBh) with my first blockchain startup, [various online courses](https://sponsor.jfwooten4.com/), and [stock investing book](https://ninetonoonsecrets.com/free-book). 📚 It is a lot of work, and hopefully the new DAO structure will help us adequately attract and nurture top media talent. 👁🗨 I'd be happy to dedicate more time on it if reasonably feasible. --- # 9. Potential DWAC Integration > This all sounds fantastic to me. The only note I'd push back on is DRSing shares being a way to earn tokens. This could be something that bad actors abuse by DRSing their own companies, not to mention hard to prove without a trusted individual going to see the stockholder lists to verify. — [Bibic Jr](https://discord.com/channels/955819881989808128/1194680207207059537/1235497588283674696) If Block Transfer is the transfer agent for issuers in question, then we could track incoming DRS transfers and issue corresponding governance tokens in real time. ⚗️ It's trivial to check if someone is an insider, put safeguards around that, and only reward someone's first direct registration. Even if we only observed TAD3 data as an impartial network peer, we can trustlessly achieve the same outcome depending on the insider identification scheme, which is an ongoing area of development per SEC Rule 15c2-11(b)(5)(i)(P) and [this post](https://lemmy.whynotdrs.org/post/1166651). 🤓 --- # 10. Local Transfer Restrictions  > I believe this is a list of the cities you can transfer certificates from one person to another. I hadn’t seen a list like this before. — [6days1week](https://discord.com/channels/955819881989808128/1141860946302734336/1236392655835893801) These geographical restrictions appear to be an outdated and unusual practice that does not align with modern regulatory frameworks or the global nature of today's securities markets. 📃 Under current SEC regulations, notably [Rule 17Ad-15](https://blocktransfer.com/compliance/signature-guarantees), there are no stipulations that should restrict the transfer of securities based on geographic location within the United States or internationally, unless specific sanctions or legal considerations apply. 🖋 These limitations may stem from legacy practices or misunderstandings of the regulations, which are increasingly incompatible with the principles of open and accessible markets. 🌎 The goal of securities regulations is to ensure fair, efficient, and transparent markets, not to impose unnecessary barriers to ownership. 🚧 Such restrictions are inhibitive, [disenfranchising investors](https://github.com/wootenwealth/sponsors/blob/main/publications/balancing-the-world.pdf) based on their location, which contradicts the global trend towards more inclusive financial participation. 💳 Given the global desire to own American securities and the widespread use of digital and blockchain technologies that transcend physical borders, any practice that limits investor participation geographically should be rigorously questioned and reevaluated. 🛡️ A consortium of national securities regulators, alongside the investing public as a whole, need to clarify these issues and align practices with the principles of modern, inclusive, and efficient markets. 🤲 --- # 11. Issuer's Master Tabulator Nuances > Brokers as I understand it, just send voting forms to EVERYONE who has any holding of the stock on the record date. I believe there's two reasons for this; Firstly the voting data they pass to the share issuing company... is just an approximated aggregate of the voting opinion for their shareholders with weighting based upon each clients shareholding. Secondly, it aids to keep up the public facing illusion that a fractional actually 'exists' in the stock trading world and they are not just cashflow and lubricant for the order pipeline. — [Born Luckiest](https://discord.com/channels/955819881989808128/1092773217187401758/1232702462599761940) This extends the broker implications from #1 and the SEC's historic leniency on Plans, as discussed. Relevantly, companies can choose their agent or another tabulation monopoly to manage and inspect the vote per [discussion thereto](https://discord.com/channels/955819881989808128/1092773217187401758/1232702462599761940). The implication from the EDGAR link there falls onto Delaware courts, where everyone operates from. When they rule the partial shares valid under the standard pretense of property rights, then the voting implications expand greatly depending on how honest your outsourced master and book tabulator [decides to act](https://discord.com/channels/1102309240145707049/1102309240741310503/1235236333291704360), given no meaningful regulation over "black box" voting results. I don't see a way to fix this without [completely digital votes](https://patent.jfwooten4.com). 🗳  [Environmental impacts](https://discord.com/channels/1102309240145707049/1102309240741310503/1237167774053171262) --- # 12. Certain Broker's 3% Cash Back Card Just so we're all on the same page, credit card fees are 2–3%. The card companies, interestingly, were originally nonprofits charging lower rates. But their "public utility status" ultimately gave way to rent-seeking profiteers that controlled the stock. 🤑 When retailers tried to add this as a line item on bills in the early 2000s, these companies pushed back and convinced them to add cash prices as a "discount." Apparently calling the payment system what it is—an added cost baked into good prices—was too harmful to their [money-printing](https://www.youtube.com/watch?v=C85pyqSqcd8&list=PLWUFvhKuc_5tD0NuFpppsQotuOj9T892C) business model. 💁♀️ All this to say that issuing banks like Coastal Community Bank in [this case](https://discord.com/channels/955819881989808128/1053098661355208794/1222586398033580123) get ~2% of transaction volumes back in revenue split with the card companies. The extra money paid chiefly comes from the fees you pay each month for a "special account." Coinbase had a similar promotion like this briefly after their IPO where you got 5% back on all debit card purchases in Stellar Lumens. 💸 Unfortunately, take rates are about half as much on debit cards, making this program even more expensive to finance. In fact, my account's card was deactivated after extensive use, and they have much lower reward rates today. ❌ All this to say that the program in question also leads to a fundamental conversation about our financial system. 🏦 I personally love the consumer protections, cash back, and other perks credit cards offer. But are these benefits, when considered across society, worth the underlying costs of a transaction tax not recouped by [uncreditworthy](https://www.youtube.com/watch?t=29&v=YUwqzeaR1lA) everyday purchasers, staggering amounts of [enslaving debt](https://www.youtube.com/watch?v=dRd-QDJsaio&list=PLWUFvhKuc_5sDW-0Elb1tc-TffW1xbpMh), and ongoing oil-based plastic producing [global pollutants](https://www.youtube.com/watch?t=241&v=JaMJi1_1tkA&list=PLWUFvhKuc_5uICfadww4PR76Rd2bl2MdT)? --- # 13. Ken Griffin Interview Comments > Take a close look at JP Morgans recent annual report and 10K under legal actions, the OCC and FED's action against them and pending DOJ outcome. They have been facilatating quite a bit of offshore trading for over a decade. I would presume, most of the prime brokers have been involved in the same unsupervised trading. — [bellweirboy](https://discord.com/channels/955819881989808128/1059573570122023022/1236768167066468403) This comment was made in response to an interview where [Ken seems to be using a teleprompter](https://discord.com/channels/955819881989808128/1059573570122023022/1236718800167112897). I'd like to talk a little more about the [routing implications](https://slate.com/business/2023/09/dumb-money-gamestop-wall-street.html#:~:text=the%20movie%20uses,a%20few.) per **[this prerequisite context](https://www.youtube.com/clip/Ugkxb4KmEoSZE6q6nlmTurodkB59S5RmGCMX).** 🌀 My perspective comes from having actively traded based on dark pool and offshore volume, including building an [AI model](https://www.youtube.com/watch?v=QafkIh2nvY0&list=PLWUFvhKuc_5vyAfq_AbWz-wSl82p_xtH9) around it before GPT3. Hopefully, [upcoming legislation](https://discord.com/channels/1102309240145707049/1237440895968608346/1237441786050514944) will finally [fix all these problems](https://www.linkedin.com/pulse/gamestop-first-successful-short-squeeze-john-wooten-xvyne/#:~:text=Luckily%2C%20the%20SEC%20is%20actively%20fixing%20this%20problem%20now). 🙌 Moreover, much of these challenges were detailed in *Flash Boys*, inter alia. All this to say, I think there is a lot more going on here that gets swept under the bridge of public oversight because of the fragmented global securities trading regulatory regimes. Ideally, blockchain solves all this with a simple, transparent, immutable record of market transactions. 🔍 We will prevail so long as we continually fight to decentralize securities trading and settlement, disintermediate global capital markets, and definitively open-source Wall Street. --- # Closing Thoughts > I am really excited for CAT - I do think we'll see if they are able to delay the 5/31 start. There are two lawsuits filed against the SEC that essentially claim the new market surveillance tool violates constitutional privacy rights. — [Chives](https://discord.com/channels/1102309240145707049/1102309240741310503/1236429874936283196) This isn't a lighthearted question in light of [recent action](https://www.cnbc.com/2024/04/30/binance-founder-changpeng-zhao-cz-sentenced-to-four-months-in-prison-.html) against CZ (and that's after a $4bln fine). ⚠ Most transfer agents today have wholly inadequate AML/KYC programs when compared to the excessive scrutiny expected from cryptocurrency exchanges. 👥 Since they were traditionally banks, I guess politicians just decided at some point that SEC-regulated transfer agents didn't need specific laws promoting America's [policy agendas](https://www.youtube.com/watch?v=Ytaa_5liwMA&list=PLWUFvhKuc_5uctL1INAcqa-Blz7fslRd9&t=5207). Given the [material privacy concerns](https://x.com/JFWooten4/status/1779619647114870933) over web3, we should continually quander and ultimately outline a global approach to inclusive financial market access. Yet another material governance consideration that I believe should come from investors themselves by means of the democratically-elected officials we have [the direct power](https://discord.com/channels/1102309240145707049/1102309241026515066/1194738748236247070) to support in alignment with our views. ☑ ## Looking Forward Together > Take the idea of market literacy a step further. What do we as a group generally mean by that? What have we learned by becoming more market-literate? What problems/concerns have we surfaced? What do we feel can be done about those concerns? — [wtfeweguys](https://discord.com/channels/955819881989808128/1068991643828633732/1236390482653745283) We have a lot to uncover together, and I'd love to have more community members on [Main Street Markets](https://www.blocktransfer.com/investors/podcast) to further document their investment background. 🎤 I firmly believe we can make better decisions in consideration of all known factors by understanding [the background](https://www.youtube.com/watch?v=pfwEXHaNM54&list=PLD_o9ntBnmGaSraKlePO35JwWLvr2dl0r) of our community members themselves. In a perfect world, that means we can best define the full scope and longstanding implications a [fundamental rethink](https://drive.blocktransfer.com/external/writer/0d1d496f6722054b2fc24fd8b926a2384a61fc70cf1251060d2d8b279d570499) of [how capitalism works](https://discord.com/channels/1102309240145707049/1102309241026515066/1235250664020639785). > W/o any competitive pressure computershare will probably not change a thing — [beyond-mythos](https://discord.com/channels/955819881989808128/1059557502183800972/1192744747933106196) Wholeheartedly agree on this point, which is why I believe we have so much potential to shake up the industry. 🏭 Consider the worst case where our step function innovation and collaboration acts as a potential "competitor" to the legacy system. 💡 What's the worst that could happen aside from forcing more innovation, transparency, and automation? By addressing the larger narrative of ownership and control within financial systems, we can begin to forge pathways towards a more equitable and transparent market built for the 99%. This is not just about exposing Wall Street; it’s about establishing a new norm for financial interactions that prioritizes equality, accessibility, and accountability. 📱 ## OCC Margin Comment Letter There are [so many problems](https://www.sec.gov/comments/sr-occ-2024-001/srocc2024001-typeh.htm) in our markets, and I can't think of any other community better suited to tack them. 🤳 In the coming week, in as much time as I can find while [packing up to move](https://www.linkedin.com/pulse/from-trader-trailblazer-web3-stock-investments-sec-review-john-wooten-zvxbc/), I'll be working on a detailed comment letter per [recent news](https://lemmy.whynotdrs.org/post/1410399). 👈 Given the [monopolization of securities trading and settlement](https://chicagounbound.uchicago.edu/cgi/viewcontent.cgi?article=1016&context=law_and_economics_wp), I believe we can convince regulators to extending FOIA access to non-governmental entities, just as they did with FTD data in the 2000s. 👨💻 These systemically important financial institutions have virtually no threat of competition given the impossibility of replacing their systems with anything outside of blockchain, which obviates the need for any such middlemen entirely. Given that this is the main reason requests have historically been denied for financial SROs, the unbelievable [lack of transparency](https://www.sec.gov/files/rules/sro/occ/2024/34-99393-ex3.pdf) in [this rule](https://www.sec.gov/comments/sr-occ-2024-001/srocc2024001.htm) might just be the straw that [breaks the camel's back](https://discord.com/channels/1102309240145707049/1102309240741310503/1235233377234194513) given the risk of options clearing amidst high volatility. 💥 > the opportunity is ripe isn't it — [Born Luckiest](https://discord.com/channels/955819881989808128/1053332205428035686/1234968235791749130) ## Isolated Community Discussions I believe in [information transparency](https://x.com/JFWooten4/status/1781101573944340987), at least for movements like this, where we aren't working on something related to national security. I understand that the original private server exists so that [top contributors](https://x.com/JFWooten4/status/1776717577344921880) can communicate in confidence and outside the risk of being misquoted out of context. 😶 Please let me know if responding to quotes in a more [public and pseudonymous](https://x.com/JFWooten4/status/1780623146724290616) manner like this steps inside the boundaries intended by having two separate Discords. Ideally, we can get [everything material](https://x.com/JFWooten4/status/1777390422517575833) into the hands of comprehensive [public oversight](https://www.youtube.com/watch?v=fpdca1gJioI&list=PLD_o9ntBnmGaaB2VMsdtrpN13KPpPcT-W), save for spam risk. Minds together stronger? 🧠

*This is heavily inspired by Consistent-Reach-152* **Background** **GME Certificate Of Incorporation:** https://www.sec.gov/Archives/edgar/data/1326380/000132638022000080/a31-certificateofamendment.htm - There **is no** mention of fractional shares **Truck Hero, Inc Certificate Of Incorporation:** https://www.sec.gov/Archives/edgar/data/1648189/000119312515346140/d17828dex31.htm - There **is a** mention of fractional shares **Delaware Code:** https://codes.findlaw.com/de/title-8-corporations/de-code-sect-8-155.html - If fractional shares are not mentioned in the by laws, then there are no fractional shares **JP Morgan:** https://www.sec.gov/divisions/investment/noaction/2016/jpmorgan-041416-206(3)-incoming.pdf - Fractional shares are not issued by the issuer but rather are account entries meant to represent the portion of a whole share (held by a broker or another party) that an accountholder would be entitled to (including ongoing appreciation and depreciation) if fractional shares existed and could be traded in the marketplace. **SEC:** https://www.sec.gov/oiea/investor-alerts-and-bulletins/fractional-share-investing-buying-slice-instead-whole-share - The way you buy and sell fractional shares differs between brokerage firms that provide this service to their customers. - You may not have voting rights if you own fractional shares. Your ability to exercise proxy voting will depend on how your brokerage firm’s fractional share investing program works. Some brokerage firms allow it, with special procedures, and some firms do not allow it at all. Ask your brokerage firm whether you will have any voting rights associated with fractional share purchases. While there have been times in the past that GameStop or what would become GameStop have issued fractional shares (ie mergers), those are one offs **Taken together, we get the following conclusions** - Only whole shares are allowed by GME - Fractional shares are happening between the individual and the financial entity.

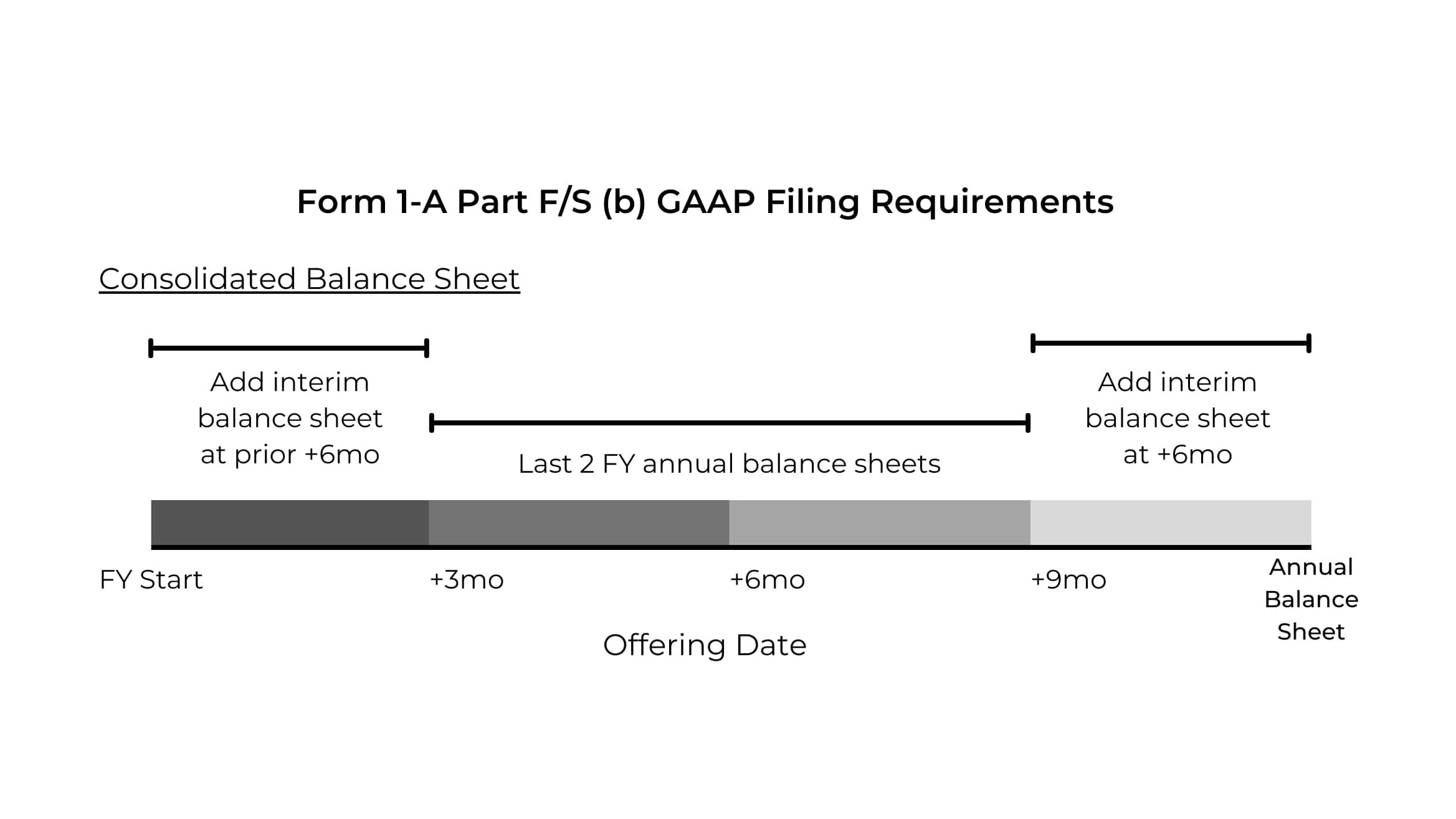

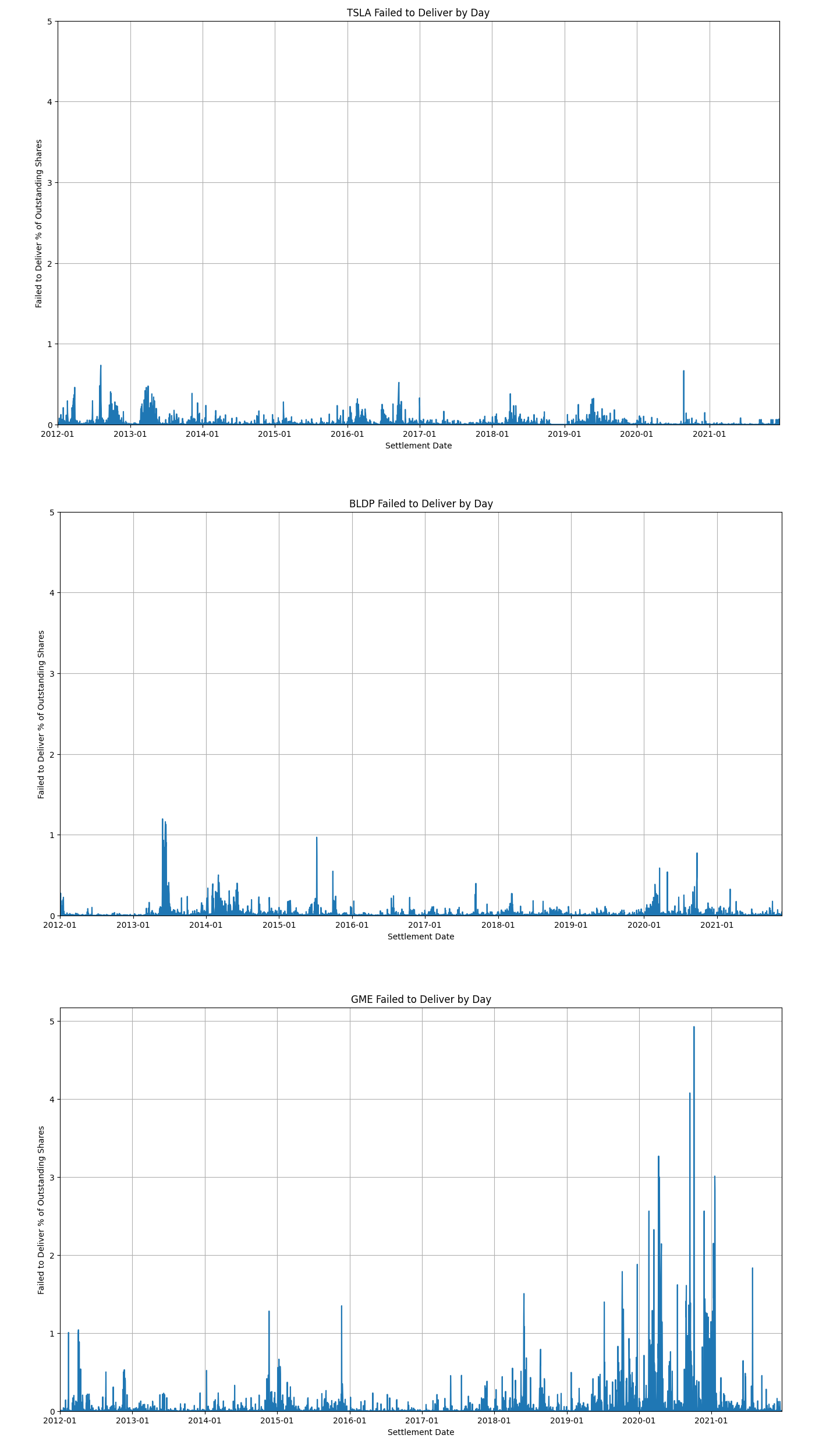

I wrote this post in an airport lounge, where I’m leeching off the buffet for 10 hours before my flight. Might not be as fun as exploring LA, but it saves a few bucks to go towards rent. 🏠 Whether we like it or not, the government knows a lot about us. They know when and where you fly. 🛩️ They theoretically know how much you earn, the stability of that income, and where it comes from. 💼 They know what kind of car you drive, how many traffic tickets you’ve racked up, and of course where you live (at least unless it’s in a [separate entity](https://www.nytimes.com/2024/03/03/us/politics/judge-ruling-corporate-transparenct-act.html)). And that’s not even mentioning *Snowden*. This isn’t a post about government oversight, but the topic seems [particularly](https://www.youtube.com/watch?v=De4QjH9fpgo&list=PL4qw3AkxFDSMxJRioymD9lFZu7JMdPWOU) [relevant](https://www.investopedia.com/tech/who-charlie-shrem/). More specifically, by the end of this post, you’ll understand my nuanced view of how we (do and) should regulate newfound digital assets. The biggest question in my mind comes down to information distribution. 🕵️♂️ Consider a currency like US dollars. There are only a handful of people that know anything material about USD value at any given time. They all work at high levels of the private profit-sharing [Federal Reserve](https://lnns.co/aMnb-DPLoIX). Considering almost the whole world uses dollars, we can safely say only ~0.0000001% of the population have **insider knowledge** about USD value. 💹 (Currencies trade against each other.) 🔄 And of course all these people presumably have tight informational and trading restrictions imposed on them by the government. Almost like corporate insider investing or trading rules. 🤔 Now consider Bitcoin, the only digital asset presently classified by our government as a commodity. 🌟 Almost from day one (compared to other blockchain networks), Bitcoin had no insiders. Certainly, Nakamoto was influential in committing original code, ideas, and limits. But, after [ghosting the industry](https://www.youtube.com/watch?v=Ew5XMjaXTF4&list=PLWUFvhKuc_5tun_1KTLil_t-7mEbOckcJ), the pseudonymous contributor disappeared from society. ## Early Bitcoin Days 🌱 In the beginning, I think there is a real argument that Nakamoto was an insider out of the [few hundred](https://www.youtube.com/watch?v=r8xCmCq1muE&list=PLD_o9ntBnmGam9BuoTr_4cjPOksi1Dl1A) early Bitcoin adopters. Namely, Nakamoto was a driving force in building out new network infrastructure themself. They were effectively releasing a new product and then letting others claim their own stake vis-a-vi mining. A [series of dot-com companies](https://www.bloomberglaw.com/external/document/X3SPR1KG000000/capital-markets-professional-perspective-airdrops-are-free-token) gave away free stock early on, in a similar spirit of fostering user adoption, increasing total investors, and gaining beneficial publicity. 👀 The SEC ultimately ruled these giveaway offerings as illegal securities law violations. 👩⚖️ And I think Bitcoin would have faced a similar outcome early on if meaningfully brought into courts before 2013. Could the government have shut it down? [Certainly not](https://www.youtube.com/watch?v=97ufCT6lQcY&list=PLWUFvhKuc_5uICfadww4PR76Rd2bl2MdT). 🏛️ But we might at least have better case law to reference today than the nuanced and intricate Ripple ruling with qualified purchasers. However, relevant to this discussion, very quickly after Nakamoto disappeared, Bitcoin effectively became a living thing. 🫀 While control of certain web2 functions was handed off to another active developer, the actual Bitcoin blockchain was off to the races with an independent, completely decentralized, and self-incentivizing system. 💸 A radical [innovation](https://www.linkedin.com/pulse/step-function-innovation-myth-overnight-success-john-wooten-akl7e/) that ultimately lead an self-organizing community of open-source developers to continually improve upon Nakamoto’s [revelation](https://www.ussc.gov/sites/default/files/pdf/training/annual-national-training-seminar/2018/Emerging_Tech_Bitcoin_Crypto.pdf). Over a decade and a half later, regulators, investors, and users alike agree that nobody has any **inside knowledge** of Bitcoin’s next steps. 🛤️ Everything from code, mining software, and wallet implementations are open-source for everyone to see. Therefore there arguably exists no insider knowledge across digital assets (and therefore no need to regulate many cryptosystems for investor protections, like with commodities disclosures). ## Corporate Securities 🏢 Let’s talk more about digital assets in the comments. 💬 I think Ethereum’s number of insiders falls between that of Bitcoin and the Bank of England. Still extremely low, and not something any regulated broker would impose insider trading disclosures around, aside from PEP checks. Insider trading laws have a relatively interesting history, which warrants a scholarly introduction: *** [](https://youtu.be/ho0dDT1drns) ### Our Current Rules Evolved from State to Federal Law 📜 Warren Earl Burger was one of the longest-serving Chief Justices in the US Supreme Court, known for his extensive experience in securities cases. Around 1980, the Court debated a series of cases questioning Federal oversight of stock lending. In *Santa Fe Industries, Inc. v. Green*, the Court had to decide whether to invoke Rule 10b-5 to protect investors in a case about a public company going private. ⚖️ In question: whether anti-fraud provisions applied to an allegedly undervalued "coerced" valuation from a major investment bank? [More thoughts](https://privates.jfwooten4.com). The Court ruled that anti-fraud procedures in Delaware law applied over Rule 10b-5. This was a common theme throughout *Bankers Trust v. Mallis*, *Rubin v. United States*, and other cases. The Court explicitly tried to delegate investor protection power down to States. 🤝 That was until *United States v. Naftalin*—a 1979 case about [failures to deliver](https://amzn.to/3uRuqx4). Big brokers were on the hook for this loss, so the Court exerted Rule 10b-5 to protect them. Based largely on Burger being absent in a surgery, it was arguably a scandalous, rushed ruling. 🏃🏽♂️ The ruling has profound implications on our current securities regulation regime. And Congress hasn’t questioned it since... *Rubin v. United States* called into question what a "sale of securities" included. The final decision was based on a minor difference in wording between the Securities Act of 1933 and the Securities Exchange Act of 1934. Its precedent was a clause in *Naftalin* arguing that securities laws were meant to be interpreted broadly to "include the entire selling process." By extension, the Court was defining the truly broad scope of power now entrusted to the SEC. 👮🏾♂️ Briefly, the ruling led to a broader interpretation of Rule 10b-5 to include almost all trading. ### Globalization of Fraud Prevention 🤥 As securities laws evolved in American courts, the main objective was always preventing fraud. 🇺🇸 The difficulty for judges was simply determining who needed to handle wrongdoings. 🫤 As our regime elevated from State to Federal oversight, so too did our markets move from local brokers to national exchanges. This trend warrants further investigation given [open web3](https://blockstream.com/satellite). >When the Legislature incorporated the Bank of Illinois, it anticipated that its stock would be bought primarily by in-state investors. Instead, most shares were purchased by financiers in the East, who deviously use the names of Illinois farmers as owners of the stock. >— Michael Burlingame Capital (mostly) flows intelligently to any market's best opportunities, no matter regulations, social norms, or your currency of denomination. 🧧 In the internet era, international companies can access international investors with the [click of a button](https://finance.yahoo.com/news/traders-flouted-bitmex-us-trading-142817763.html). 🖱️ Entering web3, how do we protect investors against widespread [fraud](https://www.sec.gov/news/press-release/2018-53), [deceit](https://www.justice.gov/usao-sdny/pr/manhattan-us-attorney-announces-charges-against-leaders-onecoin-multibillion-dollar), and [inadequate disclosures](https://fortune.com/crypto/2024/03/03/sec-coinbase-insider-trading-kraken-howey-binance-ripple-terra/) in an increasingly worldwide capital market? This roots of this question came up in last week’s [Taking Stock](https://linktr.ee/takingstockpodcast). 🔉 Namely, we were quibbling with how to prevent insider trading while protecting investor privacies. ### Is Insider Trading Bad? 🤔 Say 5–40% of public company employees have insider knowledge at any time. I think it makes sense to impose [restrictions](https://www.duke-energy.com/our-company/corporate-governance/securities-trading-policy), [public disclosures](https://www.sec.gov/Archives/edgar/data/320193/000032019321000071/xslF345X03/wf-form4_162984422696515.xml), and [ongoing oversight](https://www.occ.gov/publications-and-resources/publications/comptrollers-handbook/files/insider-activities/pub-ch-insider-activities.pdf) to prevent insider trading. My view is further detailed in [this comment letter](https://www.sec.gov/comments/s7-15-23/s71523-301019-767522.pdf). Briefly, I’ve seen market manipulation firsthand. I can almost *feel* when something doesn’t add up with the candlesticks. Would love to get on a trading podcast to elaborate. 🎙️ The challenge with insider trading is investors don’t really see their losses. 🔍 It’s a more nuanced, delayed extraction of value by corporate crooks. When they dump their shares after incredible earnings, for example, the stock still increases X%. But in reality, without insiders cashing in, you could argue that shares should’ve gone up Y%. It’s the same difficulty I face in explaining the international suppression of securities prices [from FTDs](https://www.youtube.com/watch?v=544BAtk2KLg&list=PLWUFvhKuc_5tD62OdZIv3HUaf4eBaQzG8). Mixed opinions surfaced with [Chives](https://www.youtube.com/watch?v=pfwEXHaNM54&list=PLD_o9ntBnmGaSraKlePO35JwWLvr2dl0r). I’d appreciate further discussion with everyone here. We can effectively police insider trading thoughtfully without completely revoking user privacy. 👩🏻💻 It just comes down to designing open community reporting, analysis, and enforcement tools. ## Replacing Trade Reporting Facility/Rule 613 🤓 Clearly, we aren’t building these new systems to foster increased government oversight. 📹 [A](https://www.youtube.com/watch?v=Ak455GlYqok) [number](https://www.forbes.com/sites/davidbirch/2021/05/03/im-anti-the-anti-money-laundering--rules/) [of](https://freedomandprosperity.org/2021/blog/the-pointless-burden-of-anti-money-laundering-laws/) [privacy](https://www.gisreportsonline.com/r/why-anti-money-laundering-policies-are-failing/) [advocates](https://www.elucidate.co/blog/5-reasons-why-the-global-anti-money-laundering-system-is-failing-financial-institutions) [criticize](https://content.11fs.com/article/aml-is-the-worlds-most-ineffective-policy-experiment) the [ineffectiveness of AML laws](https://doi.org/10.1080/25741292.2020.1725366). I think we can build a unified global identity system based on the principles of Gitcoin Passport which lets us stop money laundering while preserving privacy with zero-knowledge proofs. It is technically possible. 👁️ The only blocking factor is a true desire to do the right thing over [making profits](https://www.youtube.com/watch?v=WwXPZohTJ4w&list=PLWUFvhKuc_5tD62OdZIv3HUaf4eBaQzG8). Every company starts as an idea in someone’s head. In other words, 100% of the first company employees have insider knowledge, largely because the actual product might not even be built yet. 💭 Accordingly, early pitches clearly represent an insider conveying their knowledge to an investor until they can convince them to pay money for a chance at a dream. 🙇🏽♂️ For example: *** [ ](https://youtu.be/ZU8MP3vVE4s) ### Securities Anti-Fraud Laws Hold Issuers Accountable 🛡️ When one party to a securities offering knows more than another, regulation steps in to [protect the public](https://www.fbi.gov/contact-us/field-offices/lasvegas/news/press-releases/man-who-received-more-than-3-million-selling-unregistered-diamond-mine-stock-sentenced-to-four-years-in-prison). 🚨 Historically, that regulation has moved from State jurisdiction to Federal interpretation of securities laws. While this article linked extensively to FBI investigations, remember that the SEC [prepares most cases](https://www.youtube.com/watch?v=0C0Sj6Us19I&list=PLrB8PjaXSV6uFL9o9WenCw9rwCHTyju5M). [Transparency](https://www.issuers.info/) best keeps insiders honest, helping avoid the FBI in the first place. These fallbacks are important because present private placement laws rightfully allow [broad investor segments](https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor) to invest in startups. 🧠 By keeping the bar low for early fundraising, we effectively promote informed investment in the next innovators. 👍 ### Private Company Disclosures 📊 We all know murder is wrong and bad. 🙅♂️ But we still write down laws and list out criminal criteria. Knowing the rules to play by is the definition of corporate accounting, the foundation of quality investor disclosures. 🧮 Early employees often wear all hats at a startup. Say over 80% of these employees have insider knowledge. Today, it is complicated, expensive, and slow to trade these private shares. With TAD3, it’s easy, instantaneous, and free. Accordingly, we think private market secondary trading rates will skyrocket in the coming years alongside the drastic increase in [companies staying private](https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf) to avoid legacy listing costs. 💰 However, many private offering registrations or exemptions rely on unspecific compliance data. That makes it hard to ensure comprehensive reliance on current laws. 📄 Take for example a timeline of statements needed in some 506(b) placements with unaccredited investors: ***  ### Lack of Clarity 🤔 This might seem like a simple checklist of documents to follow, but in reality, there is little to no Federal definition of what constitutes a balance sheet or statement of profit, loss, and retained earnings in connection with a JOBS Act Title IV offering. This leaves private issuers guessing at standards. 😕 Don’t even get me started on a lack of Federally-recommended reporting schemes for private securities transactions, financial performance, or corporate actions. As [more innovators found startups](https://blocktransfer.com/.well-known/deck.pdf) worldwide, we need to think deeply about our increasingly distributed online market for capital. 🌎 In *Marine Bank v. Weaver*, the Supreme Court ruled that an investment contract involving a Certificate of Deposit was not a security. Chief Justice Burger wrote that investors “are abundantly protected under the federal banking laws.” Accordingly, the alternate regulatory regime protected the CDs from SEC oversight. But the ruling left open a lack of predictability for secondary transactions that is more relevant now than ever given the rise of [decentralized exchanges](https://www.youtube.com/watch?v=YFca255hXj8&list=PLWUFvhKuc_5u1sQsz-FAmRgFf9HEhyqj-). Rather, the court deferred to a stance that "each transaction must be analyzed and evaluated on the basis of the content of the instruments in question, the purposes intended to be served, and the factual setting as a whole." 🤨 Without truly answering the crucial question of horizontal commonality, we’re effectively left guessing at what a common enterprise entails under *Howey*. In a world with millions of issuers, billions of investors, and trillions of transactions, it’s not reasonable to manually inspect each and every trade. It is reasonable to regulate issuer offerings, as our present securities regime does. But I believe we need to take a step back and call into question the intent of an offering itself in certain instances of digital assets so as to comprehend the nuance of an investment opportunity over the limited horizons of Rule 144. ⏰ We need a comprehensive overarching framework to pre-empt the legacy system. ## International Blockchain Assets Standard Society 🌐 - Digital assets are **not** legacy banking, securities fundraising, or commodities trading. - They are a new global tool with widespread implications, namely for impoverished nations. - We need to organize a global Blockchain Assets Standard Society with diverse representation. *** No warranties provided. This post is not legal or professional advice. [Learn more](https://sponsor.jfwooten4.com/) and support my research, development, and free publications.

In response to: https://www.reddit.com/r/Superstonk/comments/1b1x3rg/researchers_show_reddit_users_caused_the_famous/ Options caused the January 2021 price action on GME. Derivatives are the casino. There is more money in playing options than there is in the underlying stock that those options are being played over. Infinite liquidity destabilizes the stock market because it breaks the fundamental value that stock has. People should be able to buy up all the shares of a stock, and that should cause the price of that stock to increase in value. But when market makes like shitadel are allowed to sell more of a stock than what was issued by the company in the name of liquidity, the stock market becomes detached from reality and it's impossible for a price discovery to occur. Retail has done nothing wrong. In fact what we've been doing is noble. Direct registration is putting our money into the real underlying economy. Booked shares are the only thing in the stock market that has real intrinsic value, and for the past 3 years we've been watching as retail DRS's more and more stock, and the value of that stock continually drops. It shouldn't work like this, but it does because our market is heavily manipulated by the so-called "market makers". This whole time we've been waiting for a short squeeze, which by all rights should happen but isn't because our stock market is completely detached from reality. Infinite liquidity, dark pools, swaps, derivatives are all parts of a casino and market makers are the house rigging everything against you. I would go so far as to even say this is harming our economy. Why is it so hard to start a new business? Why do executives of mega corporations give themselves huge bonuses and pay their workers so little? Why do hedge funds make huge gains but retail investors always lose? Why isn't our market working for everyone? Because hedge funds turned our stock market into a casino. Do you want to make our stock market work for everyone? Then there needs to be an end to liquidity. Options need to be illegal.

This is in regards to her post: https://twitter.com/platnumsparkles/status/1756162709479948429?s=46&t=JpDQbRm88QR_E0vD6YHerQ First I want to ask everyone to ACTUALLY READ THE RESPONSE FROM GAMESTOP. First I want to point out the last paragraph in Gamestop's response: >The false and misleading statements described above relate to the **Proposal's fundamental purpose - that the Company discontinue its DirectStock Plan and choose a new transfer agent** The proposal was to choose a new transfer agent. It wasn't an inquiry about the difference between book and plan. Platinum Sparkles lied and twisted the response into a book versus plan thing. Secondly I want to point out this paragraph in Gamestop's response: >The FAQ page explains that Computershare holds only "a portion of the aggregate DSPP book-entry shares via its broker in DTC for operational efficiency This is heat lamp, people. Right here Gamestop is pointing to Computershare's FAQ page and verifies that a portion of DSPP (plan) shares are held by the DTCC. They confirm heat lamp with this sentence in their response! **Platinum Sparkles is a liar. She is deliberately misleading investors in order to attack a DD she doesn't like. But the response from Gamestop confirms the heat lamp DD!** Computershare has confirmed that a portion of DSPP shares are held by the DTC. The SEC has confirmed that a portion of DSPP shares are held by the DTC. Gamestop has confirmed that a portion of DSPP shares are held by the DTC. Heat Lamp is the single most confirmed DD. There is no other DD more rock solid than heat lamp. I don't know what to tell you. No financial advice, but if you haven't terminated plan and are holding all your shares in pure book, you don't actually own all of your shares.

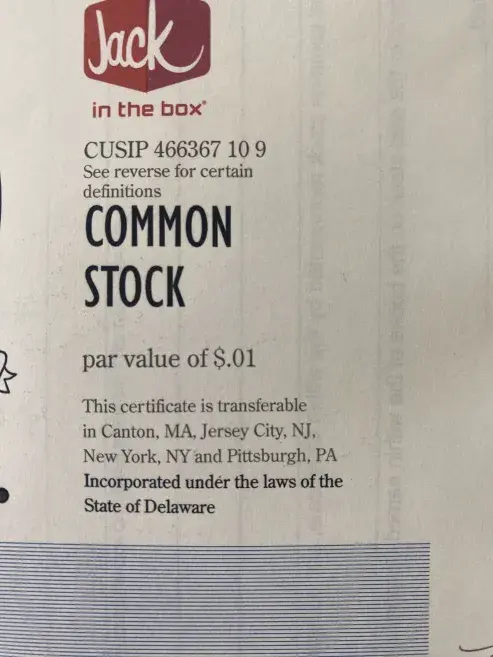

Column A (1) The first field in a file shall be the code identifying the Participant that is acting as Designated Participant for the market center under Section VIII of the Plan. The Participant identification codes are as follows: Amex - "A"; BSE - "B"; CHX - "M"; CSE - "C"; NASD - "T"; NYSE - "N"; PCX - "P"; Phlx - "X". Column B (2) The next field in a file shall be the code identifying the market center, as assigned by a Designated Participant pursuant to Section VIII of the Plan. Column C (3) The next field in a file shall be the six-digit code identifying the date of the calendar month of trading for the market center report contained in the file ("yyyymm"). Column D (4) The next field in a file shall be the symbol assigned to an individual security under the national market system plan pursuant to which the consolidated best bid and offer for such security are disseminated on a current and continuous basis. Column E (5) The next field in a file shall be the code for the one of the five types of order by which the Rule requires a market center to categorize its report. The order type codes are as follows: market orders - "11"; marketable limit orders - "12"; inside-the-quote limit orders - "13"; at-the-quote limit orders - "14"; near-the-quote limit orders - "15". Column F (6) The next field in a file shall be the code for one of the four order size buckets by which the Rule requires a market center to categorize its report. The order size codes are as follows: 100-499 shares - "21"; 500-1999 shares - "22"; 2000-4999 shares - "23"; 5000 or more shares - "24". Column G (7) The next field in a file shall be the number of covered orders, as specified in paragraph (b)(1)(i)(A) of the Rule. Column H (8) The next field in a file shall be the cumulative number of shares of covered orders, as specified in paragraph (b)(1)(i)(B) of the Rule. Column I (9) The next field in a file shall be the cumulative number of shares of covered orders cancelled prior to execution, as specified in paragraph (b)(1)(i)(C) of the Rule. Column J (10) The next field in a file shall be the cumulative number of shares of covered orders executed at the receiving market center, as specified in paragraph (b)(1)(i)(D) of the Rule. Column K (11) The next field in a file shall be the cumulative number of shares of covered orders executed at any other venue, as specified in paragraph (b)(1)(i)(E) of the Rule. Column L (12) The next field in a file shall be the cumulative number of shares of covered orders executed from 0 to 9 seconds after the time of order receipt, as specified in paragraph (b)(1)(i)(F) of the Rule. Column M (13) The next field in a file shall be the cumulative number of shares of covered orders executed from 10 to 29 seconds after the time of order receipt, as specified in paragraph (b)(1)(i)(G) of the Rule. Column N (14) The next field in a file shall be the cumulative number of shares of covered orders executed from 30 to 59 seconds after the time of order receipt, as specified in paragraph (b)(1)(i)(H) of the Rule. Column O (15) The next field in a file shall be the cumulative number of shares of covered orders executed from 60 to 299 seconds after the time of order receipt, as specified in paragraph (b)(1)(i)(I) of the Rule. Column P (16) The next field in a file shall be the cumulative number of shares of covered orders executed from 5 minutes to 30 minutes after the time of order receipt, as specified in paragraph (b)(1)(i)(J) of the Rule. Column Q (17) The next field in a file shall be the average realized spread for executions of covered orders, as specified in paragraph (b)(1)(i)(K) of the Rule. The amount shall be expressed in dollars and carried out to four decimal places. Column R (18) The next field in a file shall be the average effective spread for executions of covered orders, as specified in paragraph (b)(1)(ii)(A) of the Rule. The amount shall be expressed in dollars and carried out to four decimal places. Column S (19) The next field in a file shall be the cumulative number of shares of covered orders executed with price improvement, as specified in paragraph (b)(1)(ii)(B) of the Rule. Column T (20) The next field in a file shall be, for shares executed with price improvement, the share-weighted average amount per share that prices were improved, as specified in paragraph (b)(1)(ii)(C) of the Rule. The amount shall be expressed in dollars and carried out to four decimal places. Column U (21) The next field in a file shall be, for shares executed with price improvement, the share-weighted average period from the time of order receipt to the time of order execution, as specified in paragraph (b)(1)(ii)(D) of the Rule. The period shall be expressed in number of seconds and carried out to one decimal place. Column V (22) The next field in a file shall be the cumulative number of shares of covered orders executed at the quote, as specified in paragraph (b)(1)(ii)(E) of the Rule. Column W (23) The next field in a file shall be, for shares executed at the quote, the share-weighted average period of time from the time of order receipt to the time of order execution, as specified in paragraph (b)(1)(ii)(F) of the Rule. The period shall be expressed in number of seconds and carried out to one decimal place. Column X (24) The next field in a file shall be the cumulative number of shares of covered orders executed outside the quote, as specified in paragraph (b)(1)(ii)(G) of the Rule. Column Y (25) The next field in a file shall be, for shares executed outside the quote, the share-weighted average amount per share that prices were outside the quote, as specified in paragraph (b)(1)(ii)(H) of the Rule. The amount shall be expressed in dollars and carried out to four decimal places. Column Z (26) The next field in a file shall be, for shares executed outside the quote, the share-weighted average period of time from the time of order receipt to the time of order execution, as specified in paragraph (b)(1)(ii)(I) of the Rule. The period shall be expressed in number of seconds and carried out to one decimal place. !< data source: https://www.citadelsecurities.com/rule-605-606-statements/

https://www.reddit.com/r/Superstonk/comments/18klv9u/how_to_take_down_a_ponzi_some_speculations_on_how/ He missed a cash dividend. It's odd to me every time a dividend comes up I see people against it, or they want a NFT dividend like the DTCC can't BS their way through that. I don't think a NFT dividend would work. It was tried once when Overstock was shorted and it flopped. Cash is king and there is no substitute for cash in the market. They can't pay out monopoly money or IOU's when a cash dividend happens. If Gamestop hands the DTCC X amount of dollars and says this is for a $1 dividend to each shareholder, the shorts are fucked. They have to pay the full amount of the dividend to every shareholder who bought a naked short and they have to pay out of pocket. Apparently RC can invest Gamestop funds in stocks now, and I saw a great suggestion that Gamestop should invest in dividend stocks and then issue a "pass through dividend" to shareholders when those stocks issue dividends. So say Gamestop invests in Coca Cola - when Coke issues a dividend, Gamestop would simply pass that cash onto GME shareholders as a dividend. So we get a cash dividend, paid for by Coke. And every time that happens, the shorts have to pay the difference. All the naked shorts they've issued over the past 3+ years also get the dividend. This is how we blow up the Ponzi scheme. Every time they short sell more, they get more money. How do we use the naked shorts against them? A cash dividend. It's the killing blow and that's why every time it comes up, people are against it. Think of it as a litmus test. Who is part of a fifth column and actually working against us?

1) Real fine$ for FTDs [NO "margin call" waivers at NSCC's whim] 2) Mandatory Buy-In 3) If Buy-In fails, raise offer$ until it closes 4) Suspend & close accounts of brokers who FTD 5) Create criminal law for BDs who harm #HouseholdInvestors 6) Give power back to states @NASAA

https://www.reddit.com/r/GME/comments/o7kyoe/si_minimum_22642_ucriand/ https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf

"...if if the general public uhhhh investor is uhhhhh pitted against the hedge funds over time the hedge funds uhhhhh will come out ahead." bill Gates.

I saw this deleted at Superstonk. If they are trying to silence it, then it must be good. [https://halturnerradioshow.com/index.php/en/news-page/world/bank-books-149-trillion-equity-swap-due-to-expire-settle-on-december-15](https://halturnerradioshow.com/index.php/en/news-page/world/bank-books-149-trillion-equity-swap-due-to-expire-settle-on-december-15) I wonder how many GME shorts are hidden in these swaps???

*"In a little-known quirk of Wall Street bookkeeping, when brokerages loan out a customer’s stock to short sellers and those traders sell the stock to someone else, both investors are often able to vote in corporate elections.* *With the growth of short sales, which involve the resale of borrowed securities, stocks can be lent repeatedly, allowing three or four owners [or more] to cast votes based on holdings of the same shares.* *The Hazlet, New Jersey–based Securities Transfer Association, a trade group for stock transfer agents, reviewed 341 shareholder votes in corporate contests in 2005. It found evidence of overvoting—the submission of too many ballots—in all 341 cases.*" _________________________________________________________________________ For the record, this article has been largely scrubbed from Bloomberg Markets' website, as well as the entire internet.

youtu.be

youtu.be

"... and part of that is because of what you just said; Payment-for-Order-Flow which is, yes, banned in the U.K., in Canada, and Australia and the European Union..."

Inspired by u/Region-Formal.

Feel free to join this community on X focused on GameStop and DRS: https://twitter.com/i/communities/1726959023889555589

Let me summarize for others - buy pressure is internalized all day long suppressing positive price action, while sells hit the lit exchange all day long, making it easy to artificially drive the price down. Buys are then satisfied via dark pool block trades after hours with minimal impact on the price. In addition, thousands of shares sold but not yet purchased accumulate as daily fails to deliver, to be delivered by a certain later date, but can be satisfied by purchasing far out of the money call contracts and selling far out of the money puts and marking those synthetic longs as actual shares on paper. Interestingly, the FTD data from October is now late by more than 2 weeks for some undisclosed reason. And given the upcoming holidays, FTDs will likely qualify for a deferral period to be covered at a later date, also undisclosed publicly. If fails to deliver accumulate by a certain amount over a certain time period and are not satisfied in a timely matter, the equity is then placed on the regulation threshold list at which point it cannot “legally” be sold short. GME has not been on the RegSHO threshold list since before the 2021 gamma squeeze. Instead, the ETF with the largest holding of GME shares by percentage, XRT, has been perpetually on the RegSHO threshold list, because the ETF is being pillaged for its GME shares which are then used to further short and drive down the price of GME. Typically, over 1 million GME shares are borrowed daily and used to short the stock, but curiously they are always somehow returned before the end of the day, keeping the borrow rate low. Rinse and repeat all of the above and here’s the last 6 months of GameStop price action. Note that in this time period GameStop beat earnings estimates by 79% and reduced losses by 97% year over year. [(see link for graphic)]

XPost due to me being new

markets.businessinsider.com

markets.businessinsider.com

Possible and likely, I guess, but more possible and likely is, ya know, greedy robo-like-psycho-humans.